Northmarq’s National Development Services division brokers sale of 3-acre Daytona Beach redevelopment site

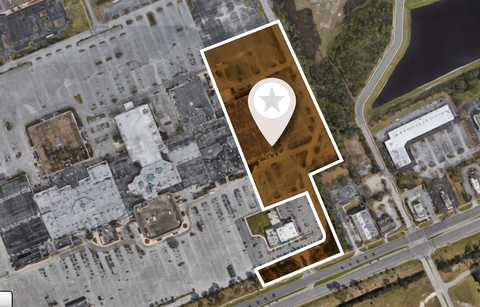

MINNEAPOLIS (May 13, 2024) — Northmarq’s National Development Services team of Scott Lamontagne, Jeannette Jason, Diane Sogal, Chase Gardner and Nico Ramirez has completed the $3.5 million sale of the Elm Creek Redevelopment site, a 13.26-acre redevelopment site located at 1700 W. International Speedway Blvd. in Daytona Beach, Fla. Formerly a Sears retail store at the Voluisa Mall, the property was built in 1975 and offers the opportunity for a limited serve hotel redevelopment near the Daytona International Speedway.

Northmarq represented the seller, Elm Creek Real Estate LLC. The buyer was a private hotel developer.

“This transaction is extremely notable in today’s business climate,” said Lamontagne. “The buyer agreed to a substantial non-refundable deposit and a 15-day total timeline to close as a result of the competition that Northmarq marketing efforts were able to create!”

Situated near the home of the Daytona 500, the most prestigious race in NASCAR, the Elm Creek Redevelopment Site offers an ideal location with connectivity Daytona’s major employers and amenities, such as Daytona Beach. The property will fill the need for new rental housing in an unparalleled location with direct access to major highways and visibility along W. International Speedway Boulevard (45,500+ cars per day).