Walgreens after Sycamore: What shrink-to-core means for retail real estate

A take-private that resets the corner

Thousands of Walgreens corners are about to be repriced. Sycamore Partners closed its take-private on August 28, 2025, ending Walgreens’ public run. Media reports peg the equity value near $10 billion, and some outlets cite total value in the low $20 billions, depending on what’s included. What Sycamore really bought is control of some of the country’s most visible intersections and the right to decide how those corners get repositioned. For years, long leases and corporate guarantees made Walgreens a default net lease anchor. That assumption is now in play.

How Walgreens lost its edge

The slide came from years of overreach and underperformance, not one dramatic failure. The 2014 Alliance Boots deal shifted leadership overseas. The attempted Rite Aid merger left overlap even as Walgreens bought 1,932 stores and three distribution centers. Healthcare ventures like VillageMD consumed capital but didn’t fix the in-store experience.

By the early 2020s, service was uneven, labor disputes grew and closures mounted. Customers felt the change when they walked through the door, and confidence slipped with it.

Timeline: Walgreens’ reset at a glance (2014-2025)

- 2014. Alliance Boots acquisition closes for $15.3 billion. Attention and capital shift overseas and the U.S. store base loses focus.

- 2017–2018. Rite Aid merger collapses. Walgreens buys 1,932 stores and three DCs. Overlap grows; marginal locations enter the system and lease obligations rise.

- 2019–2022. Operations stumble and service turns uneven as traffic shifts to digital and value channels. The footprint begins to feel heavy.

- June 2023. Company plans 150 U.S. closures and 300 Boots U.K. closures. The move marks a retreat from the saturation strategy.

- January 4, 2024. Dividend cut nearly in half to $0.25. Management prioritizes cash and signals lower tolerance for long-tail stores and costly bets.

- February 26, 2024. Removed from the Dow as Amazon joins. Perception shifts from dependable blue chip to turnaround, pressuring the cost of capital.

- March 28, 2024. Records a $5.8 billion VillageMD impairment. The healthcare pivot fails to carry store economics, and the balance sheet takes the hit.

- June 2024. Company comments indicate about 25% of U.S. stores are underperforming and under review. Rationalization becomes policy and repricing risk enters net lease underwriting.

- January 30, 2025. Dividend suspended. Liquidity is preserved for the reset and tougher lease conversations move to the foreground.

- August 28, 2025. Sycamore closes the take-private. Private ownership can move faster on closures and lease resets, forcing a market wide reassessment of drugstore credit.

Competitive backdrop

- 2018. CVS completes the Aetna acquisition. An integrated care model pulls profit into services and payer economics and widens the strategic gap as Walgreens searches for a core identity.

What Sycamore will do

Sycamore isn’t trying to rebuild the old Walgreens. The plan is a leaner, more disciplined company. That means fewer stores, tighter cost controls and sharper focus on the most productive corners. Overlapping or underperforming sites are likely to close. Non-core operations could be spun off. Even long leases once considered untouchable may come back to the table.

What remains unclear is the pace. Sycamore could push a disruptive wave of closures or take a phased, measured approach. Most market watchers expect a mid-term pace, which could chip away at investor confidence as the store count shrinks.

It’s a strategy of subtraction. The Walgreens that emerges will be smaller and built to maximize cash flow at the strongest intersections rather than stretch across every market.

Why it matters for CRE

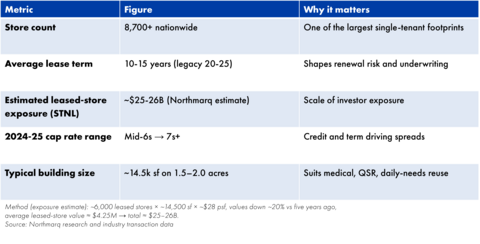

Walgreens has long been one of the most common tenants in single-tenant net lease portfolios. Original leases often ran 20 to 25 years, though many re-casts now average closer to 10 to 15. Those corporate guarantees once gave investors and lenders a strong sense of security, but that perception is shifting.

Pricing tells the story. Cap rates that hovered in the mid-6% range during 2024 are moving into the 7s and higher in 2025, with spreads widening by market, lease term and credit. As of March 2025, roughly $6 billion of CMBS exposure across more than 360 loans ties directly to Walgreens, keeping lenders on alert as renewals approach.

At the same time, each closure creates an opening. CVS is best positioned to capture prescription transfers. Grocery chains have shown they can take share when pharmacies shut down, as seen during Rite Aid’s recent exits in Ohio and Michigan. Other categories are stepping in too. Behavioral health and urgent care operators, along with nonprofits such as Goodwill, have backfilled boxes where occupancy costs pencil.

Market snapshot: Walgreens in the net lease space

Market perspective

Prime corners remain attractive to daily-needs users. Urgent care, dental, QSR, discount grocers and value retailers are active backfill candidates. But sentiment is split. Some see resilient demand and quick reuse at A-class sites. Others warn that renegotiations and credit pressure will ripple through portfolios. Both views point to the same outcome that strong corners backfill, while weaker ones do not.

Successors on the corner

Not every box will backfill the same way. Infill sites can be subdivided for multiple tenants or repositioned into medical, grocery or mixed-use projects. Municipalities will shape speed and feasibility. As more sites convert into ground leases, entitlement processes become pivotal, and cities may need to rethink zoning when visible corners sit dark.

Signals to track

- Credit standing. Changes in ratings or outlook will move single-tenant pricing.

- Geographic concentration. Closures likely cluster in the Midwest, where performance lags, and along the coasts, where higher occupancy costs invite rationalization.

- Lease renegotiations. Early re-casts will set benchmarks for term, rent and spreads.

- Backfill velocity. The pace at prime intersections will set the tone for lenders and investors.

- Municipal response. Entitlements and zoning will determine how long prominent corners sit vacant.

Guidance for stakeholders

- Landlords. Model rent resets, review maturities and prepare for subdivision or multi-tenant reuse.

- Lenders. Stress test portfolios, re-underwrite with shorter lease certainty and account for DSCR impact.

- Investors. Focus on infill with strong tenant depth, budget for capex and evaluate conversions where zoning allows.

The Risk of waiting

Delays carry consequences. Owners risk vacancies, lenders face repricing shocks and investors may miss the chance to secure prime corners at reset values.

Final thoughts

The Walgreens reset is bigger than one tenant. Sycamore’s strategy could play out as a disruptive wave of closures or a slower, phased pullback. The market leans toward the latter, which means investor confidence will erode gradually as more locations come offline.

The impact won’t be isolated to Walgreens. Their footprint has shaped how investors view net lease fundamentals for decades, so this reset will influence underwriting standards across the sector. The fallout isn’t catastrophic, but it will change how decisions get made.

Insights

Research to help you make knowledgeable investment decisions