Position, Not Prediction: Why Execution Beats Speculation in Today’s Lending Market

Rate sentiment has improved, and the next six to 12 months may bring some easing. That’s welcome, but the past two years taught a costly lesson: waiting for the “perfect” print has hurt many owners. If your deal underwrites at today’s rates and proceeds, capture certainty and optionality now rather than gamble on timing. Investors who acted early by locking, refinancing or securing preferred solutions are in stronger shape than those who waited. With $384 billion of multifamily loan maturities pushed into 2025 and growing lender fatigue, the risk of inaction is high.

Today’s Multifamily Lending Landscape

The extension of hundreds of billions in CRE loans into 2025, largely driven by “extend-and-pretend” tactics, has created an environment where lenders are increasingly fatigued. This approach – extending loans in hopes that market conditions improve – has compounded pressure, leaving borrowers in a delicate position.

Real-world examples show the risks of hesitation. Multifamily investors who sought smaller cash contributions last fall missed opportunities to lock in rates while they were more favorable. Fast forward nearly a year, and the financial gaps they need to bridge have only widened. The key takeaway? Delaying a decision can quickly erode any presumed benefits. Borrowers who act decisively are better equipped to weather these market dynamics and position themselves for greater stability.

For owners, the challenge goes beyond access to debt. Rising insurance premiums and operating expenses are squeezing cash flow, leaving less capacity to absorb higher financing costs. At the same time, valuations risk resetting lower if they wait, magnifying the execution risk of delay.

Why “Works Today” Still Beats “Maybe Later”

Access matters more than hypotheticals. Credit boxes remain tight, and lender fatigue is real. Those who moved early are better positioned.

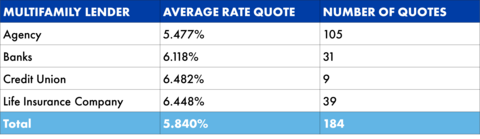

Rates vary across stabilized multifamily financing. Recent Northmarq quotes show a range, with average rates varying more than 300 basis points between the lowest and highest, underscoring how lender choice and timing can shift outcome.

Relief isn’t guaranteed. Even with a constructive outlook, counting on 75-100 bps of decline is a speculative bet. A business plan built only on that hope is exposed.

Structures preserve upside. Early or forward locks, float-downs where available, caps on bridge and preferred equity help bridge gaps while maintaining flexibility.

A Practical Lens for Decisions "If the numbers work at today’s cost and the property clears DSCR, it’s a go. If the deal only makes sense after a dramatic shift in rates, it’s the business plan that needs adjusting—not the calendar."

The Benefits of Acting Now in Multifamily Financing

Acting now does more than protect against higher costs. It gives borrowers the ability to shape outcomes while options are still on the table. In the last 90 days, multifamily quotes varied by more than 300 basis points, underscoring how execution timing and lender selection can swing results.

Borrowers who move now can lock competitive terms and still keep room for improvement. One way is through early or forward locks that secure today’s certainty. Float-down features, when available, allow investors to benefit if rates ease after closing. Caps on bridge loans help contain exposure, and preferred equity can close proceeds gaps without pushing leverage too high.

Even alternatives such as CMBS, which were less common in stronger markets, can create viable solutions when agency or bank financing is limited.

In recent closings, we’ve seen preferred equity fill 10% to 15% proceeds gaps when banks pulled back. CMBS execution, even at a wider spread, has enabled borrowers to refinance maturing debt that banks declined under tighter underwriting. These tools may not be first-choice options in stronger markets, but they’re proving decisive today.

Over the past 90 days, Northmarq’s Debt + Equity teams have received 184 rate quotes from multifamily lenders, covering a wide spectrum of options. The 310-basis-point spread between the lowest and highest average rates underscores a dynamic lending market where borrower outcomes vary significantly based on timing, lender type and strategy.

The agency quotes skew the overall average lower, but bank quotes clustered between 6% and 6.25%. That fragmentation proves a single deal can take on very different outcomes depending on who the lender is and when you approach them.

Moving Forward

Even if rates ease, the groups that come out ahead will be those that secure certainty and preserve flexibility. Locking competitive terms now protects against widening spreads. Using structure keeps room for upside. Moving today avoids the execution risk that comes when lender boxes tighten. If your deal works in the current environment, the time to act is now.

Insights

Research to help you make knowledgeable investment decisions