Understanding Percentage Rent in Commercial Real Estate

Percentage rent is a lease structure that mixes fixed rent with performance-based rent. It gives landlords a share of the tenant’s sales while offering tenants breathing room during slower months. You’ll find this model most often in retail leases, especially in shopping centers, lifestyle hubs and mixed-use developments where tenant sales directly influence property value.

Let’s break down how percentage rent works and explore whether it fits your investment strategy.

How Percentage Rent Works

A percentage rent lease typically includes two components:

- Base rent: A fixed monthly amount paid regardless of sales performance

- Percentage rent: A variable rent component calculated as a percentage of gross sales that exceed a predetermined threshold, known as the breakpoint

This structure aligns landlord and tenant interests, especially in high-traffic or seasonal environments where sales volatility is expected.

Where Percentage Rent Shows Up Most

Percentage rent is especially common in enclosed malls, where kiosks and smaller tenants often pay minimal base rent but a higher percentage of sales. In some cases, leases are structured as percentage rent only, with no base rent at all. This is typical in high-traffic areas or for short-term tenants.

Understanding Breakpoints: Natural vs. Artificial

The breakpoint is the sales threshold above which percentage rent is triggered. There are two primary methods for establishing this threshold:

- Natural breakpoint: Calculated by dividing the annual base rent by the agreed-upon rate.

Example: If the annual base rent is $300,000 and the percentage rent is 10%, the natural breakpoint is $3 million in annual gross sales

- Artificial breakpoint: A negotiated figure that may differ from the natural calculation. Landlords and tenants often agree on a sales threshold that reflects projected performance, market conditions or strategic considerations, such as incentivizing early occupancy or accounting for ramp-up periods.

The choice between natural and artificial breakpoints can significantly impact lease economics. You should model both options carefully during negotiations.

Why Percentage Rent Is Triggered by Conditions

Some leases introduce percentage rent only when certain conditions are met. This often acts as a fallback when the center underperforms. For example, if occupancy drops below 60%, the lease may switch from base rent to percentage rent. This structure helps landlords maintain income during downturns but can shift risk to tenants.

Industry Benchmarks for Percentage Rates

Percentage rent rates vary by tenant category and margin profile. While there is no universal standard, typical ranges include:

- Retail stores: 5% to 10%

- Restaurants: 6% to 10%

- High-margin, low-volume (e.g., furniture, jewelry and liquor stores): May pay higher percentages due to stronger margins despite lower sales volume

- Low-margin, high-volume (e.g., discount stores and supermarkets): Tend to pay lower percentages due to thinner margins

Landlords may also use tiered rent structures, caps or floors to manage volatility and incentivize growth.

Percentage Rent and Occupancy Cost Targets

Percentage rent can help tenants manage their occupancy cost ratio, which is the percentage of gross sales spent on rent. For example, a restaurant might aim to keep occupancy costs below 8% to maintain healthy margins. Structuring rent as a percentage of sales helps align lease terms with these financial targets.

Examples and Use Cases

Here’s a simple example: If a monthly base rent is $25,000 and the agreed-upon percentage of sales is 10%, the natural breakpoint is $250,000 in sales ($25,000 ÷ 0.10).

Usually, 6% is the standard percentage amount used in the retail sector. However, some industries, such as hardware and department stores, might use lower percentages. On the flip side, sit-down restaurants and other businesses with high profit margins might pay a higher rate ranging from 6% to 10%.

When Is Percentage Rent Used in Retail Leases?

The percentage rent model is commonly used in retail properties and shopping centers. It allows landlords to capitalize on tenants that generate high yearly sales, increasing their overall returns.

Landlords also benefit from tenants with variable income streams, such as retailers that generate high sales during specific periods. For example, by charging businesses a lower base rent during the year, a landlord can attract more tenants and then collect additional revenue during the busy holiday shopping season.

Benefits of Percentage Rent

For Landlords:

- Revenue upside: Capture additional income during high-performing sales periods

- Tenant alignment: Encourage landlords to support tenant success through marketing, co-tenancy and property enhancements

- Leasing flexibility: Lower base rents can attract tenants in competitive markets or during economic uncertainty

For Tenants:

- Cash flow management: Lower fixed rent during slower months helps preserve working capital

- Prime location access: Percentage rent structures can make high-demand locations more financially accessible

- Shared risk: Rent obligations scale with performance, reducing pressure during downturns

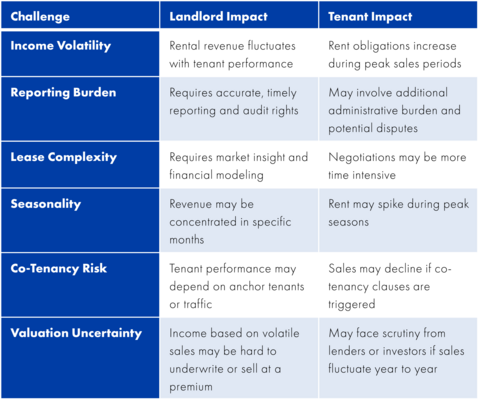

Challenges of Percentage Rent

A percentage lease can be unpredictable compared to a fixed rental agreement, especially if a retailer's sales fluctuate. A landlord might not generate any additional revenue in months when a tenant doesn't hit the natural breakpoint. Also, a landlord depends on a tenant accurately reporting their sales performance.

Tenants may face higher rent during peak sales periods. There may also be conflicts with a landlord about sales reporting transparency. While this lease type offers flexibility and advantages, it also introduces operational and financial complexities.

Here’s a breakdown of common challenges and how they affect both parties:

From a valuation perspective, percentage rent can introduce subjectivity. If tenant sales vary significantly—say, $5M in Year 1, $4M in Year 2 and $5.5M in Year 3—buyers and lenders may disagree on how to value the income stream. Some may underwrite to the lowest year, while sellers may push for an average. This variability can complicate pricing and financing decisions.

These risks highlight the importance of well-defined lease terms, audit provisions and performance expectations.

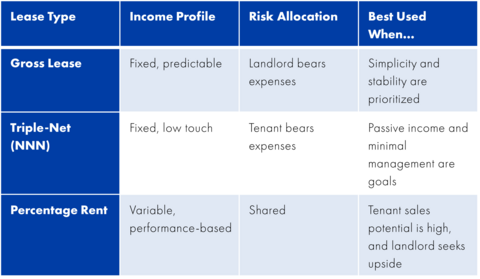

Comparing Percentage Rent to Other Lease Structures

Lease structure directly impacts asset performance, risk exposure and valuation. While percentage rent offers upside potential, it introduces variability that may not align with every investment strategy.

Here’s how three common structures compare:

Strategic takeaway: Percentage rent isn’t a replacement for gross or NNN leases. It’s best used when tenant performance is directly tied to asset value, such as in lifestyle centers, entertainment districts or repositioned retail.

Percentage Rent in an Inflationary Environment

In an inflationary market, fixed lease structures can lose value in real terms. As operating expenses such as insurance, maintenance and property taxes rise, landlords may find that scheduled rent escalations fail to keep pace. This can compress net operating income and reduce long-term asset value.

Percentage rent offers a potential solution. Because rent is tied to tenant sales, landlords can benefit when inflation drives up retail prices. Even if unit sales remain flat, higher transaction values can increase gross sales, which boosts percentage rent income.

For tenants, this structure offers flexibility. If inflation reduces consumer demand and sales decline, tenants are not burdened with high fixed rent. They pay only the base rent, which helps preserve liquidity and reduce the risk of default.

However, inflation can also compress margins or reduce traffic, introducing risk. To mitigate this, leases should include audit rights, realistic breakpoints and seasonal considerations.

What CRE Investors Should Evaluate

Before entering a percentage rent lease or acquiring an asset with one in place, investors should conduct a thorough evaluation that includes both quantitative modeling and qualitative assessment.

Tenant Category or Business Model

Determine whether the tenant operates in a high-margin, high-volume sector such as restaurants or specialty retail. Understand how their business model responds to economic cycles and consumer behavior.

Sales History and Reporting Practices

Review the tenant’s historical sales performance and reporting reliability. Ensure the lease includes clear definitions of gross sales, exclusions and audit provisions.

Location and Foot Traffic

Evaluate whether the property is in a high-traffic area that supports consistent sales. Consider co-tenancy dynamics, visibility, accessibility and the surrounding tenant mix.

Seasonality and Revenue Volatility

Determine whether the tenant’s sales are steady throughout the year or concentrated in specific periods. In highly seasonal businesses, it may be more appropriate to structure breakpoints on a quarterly or annual basis.

Lease Structure and Legal Protections

Assess whether the breakpoint is natural or artificial and whether it aligns with projected performance. Review any escalation clauses, tiered percentage rates or caps that may affect rent variability. Confirm that the lease includes provisions for co-tenancy, early termination and default remedies.

Investors should model multiple sales scenarios to understand how percentage rent affects cash flow, valuation and capital stack. This analysis should be integrated into broader asset management and leasing strategies.

Final Thoughts

Percentage rent can unlock upside, strengthen tenant relationships and offer built-in flexibility. When applied strategically, it becomes a valuable tool for enhancing long-term asset performance.

However, it’s not for every investor or asset. Success depends on tenant transparency, solid lease modeling and clear reporting structures. Investors should treat percentage rent not as a trend, but as a deliberate strategy within a well-aligned portfolio.

Ready to Evaluate Percentage Rent for Your Portfolio?

Now that you understand how percentage rent works and why it matters in today’s market, it’s time to explore how this lease structure can support your investment goals. Whether you're underwriting a retail acquisition or negotiating a new lease, Northmarq’s team can help you:

- Model performance-based income scenarios

- Assess valuation risks tied to tenant sales

- Structure leases that balance flexibility and long-tern returns

- Navigate inflationary pressures with responsive rent strategies

Take the next step toward building a resilient and performance-aligned portfolio. Connect with a Northmarq advisor to explore how percentage rent can strengthen your leasing strategy.

Explore more:

Insights

Research to help you make knowledgeable investment decisions