Commercial Real Estate Investment Options

Northmarq Fund Management Research

Commercial real estate (CRE) investments can be made in the form of either equity (property ownership) or debt (lending) strategies, and there are opportunities to invest in these sectors across both public and private markets. As an overall asset sector, real estate offers several beneficial characteristics including reduced correlation, cash flow/income returns, and tangible asset value. In the case of equity investments, they have inflation-hedging characteristics, while debt investments may have deflation-hedging characteristics when benchmark rates decrease. Real estate is predominantly a leveraged asset class, which increases volatility of returns (in both good ways and bad) for investors. Real estate returns are determined collectively by the combination of (among others) benchmark interest rates, the cost and availability of debt and equity, leasing supply and demand, and investors’ expectations of future growth in net operating income and cash flow.

On the debt side, there are lending opportunities across multiple leverage points in the capital structure. Borrowers with traditional needs and stable properties will usually seek first mortgage loans from institutional sources including banks and insurance companies. Investors in mortgages can hold those loans unleveraged or add a bit of warehouse leverage to enhance returns from the otherwise lowest-risk portion of the capital structure. For borrowers in need of higher loan-to-value proceeds, investors can access incremental return by adding B-notes, or supplement mortgage debt with subordinate financing options including mezzanine loans, preferred equity and participating preferred equity. For properties not yet stabilized, transitional/bridge loans are often available at higher spreads on a floating rate basis.

On the equity side, there are also multiple channels that investors can utilize to invest in CRE. Public market opportunities are available in the form of publicly traded REIT shares and REIT preferred securities. Private market opportunities include property syndications, private REITs, Fund limited partnership interests, joint ventures and direct ownership.

For both debt and equity, these underlying investment instruments can then be layered into public debt or equity formats such as CMBS, CLOs, REIT common equity and REIT preferred shares.

The following is a simple illustration of the four-quadrant structure of the commercial real estate market.

| Public | Private |

Debt | CMBS, Agency Bonds, Publicly Traded Mortgage REITs | Funds, Banks, Insurance Companies, Non-Bank Private Lenders |

Equity | Publicly Traded Equity REITs, REIT Preferred Shares | Property Syndication, Multiple Asset Funds, Joint Ventures, Direct Ownership |

The chart following is an example capital stack, showing common loan-to-value ratios for each of the financing options described above.

Illustrative Capital Structures*

The diversity of transaction structuring options in CRE presents opportunities for investors at each level of the capital structure. This allows investors to select the opportunity that best matches their risk/return profile.

Investment Options and Key Characteristics

Mortgage Loans

First mortgages can be procured from banks, insurance companies, agencies (Fannie, Freddie, HUD) and Wall Street lenders in the form of commercial mortgage-backed securities (CMBS). There are also countless non-bank private lenders in the market. First mortgages are secured by a lien on the property and hold the most senior position in the capital stack.

Pricing and Structure - The loan-to-value ratio (LTV) of mortgages generally average 60-65%. Interest rates can be fixed or floating, and rates are determined by current market conditions (economic conditions, benchmark interest rates) as well as property-specific factors (property type, asset class, location, tenant mix, leverage level, property sponsorship, etc.). Loan rates are ultimately priced from the relevant similar-term index (SOFR, USTs) plus a loan spread above the index to account for the added risk and lesser liquidity. Loans can be structured as non-recourse, partial-recourse, or full recourse depending on the lender and borrower involved. Banks favor recourse financing (borrower guarantee of repayment), whereas loans from CMBS originators, insurance companies, and many private funds are more often structured as non-recourse.

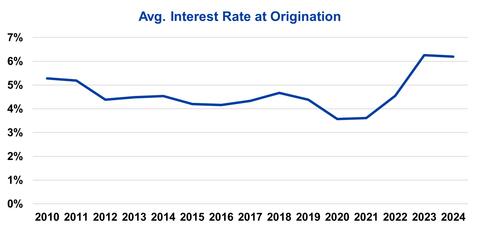

The following data shows the average interest rate for mortgages tracked by Northmarq by year of origination:

Source: Northmarq. Data includes Bank, CMBS, Life Company, Agency mortgages

In reviewing the average overall interest rates for mortgages maturing in 2025 and 2026, we found these rates to be 4.91% and 4.59%, respectively, compared to new loan rates above 6.0% on average.

Subordinate Debt Structures

Subordinate debt instruments can offer a yield premium to mortgage debt and, in some cases, represent a lower-risk alternative to equity ownership. Mezzanine loans and B-notes have similar investment risk and return objectives, although with differing control features. Preferred equity represents a similar economic position to debt collateral options, but it involves a more equity-like structure. As further described below, in cases of default, preferred equity outcomes are less-binary than mezzanine loans, and often result in superior risk-adjusted returns.

- B-Notes - Lenders can bifurcate mortgage loans into a senior A-note and junior B-note. This technique is often used when a lender favors most aspects of a potential financing, but the borrower needs higher LTV “stretch” proceeds than the mortgage lender can provide. In this scenario, the originating lender will often keep the A-note and sell off a junior B-note to an investor targeting a higher-risk/higher-return position. The A-note will have priority of payment for principal and interest payments, and the B-note will carry a higher subordinate yield. In this structure, the borrower makes one payment, which is then bifurcated into separate amounts paid to the A- and B-note holders. In addition to a higher yield, the B-note holder can act first to protect its investment in the event of borrower delinquency or default under the single mortgage securing both notes. Only if the B-note holder declines to act or provide the capital necessary to cure a default, pursue foreclosure, or otherwise restructure the mortgage with the borrower and the A-note lender, would the A-note lender become fully in control.

- Mezzanine Loans – Mezzanine loans are a junior note, secured by a pledge of ownership interests in the borrowing entity. The ownership interests are typically certificated (converted into stock) and the mezzanine lender’s path to title in a default would be a more streamlined UCC foreclosure (as opposed to a more cumbersome judicial foreclosure in the case of first mortgage lending). Mezzanine loans are generally co-terminus with the senior mortgage loan and require an intercreditor agreement between the mezzanine and mortgage lenders. The intercreditor agreement will allow the mezzanine lender a specified number and duration of cure rights in the event of borrower default, providing the first opportunity to pursue a workout or foreclosure in advance of action by a first mortgage holder.

- Preferred Equity – Preferred Equity is a type of subordinate financing that takes the form of a senior class of stock within the borrowing entity. The preferred equity generally receives senior distribution rights to pay current interest and/or accrued interest (after any senior debt obligations have been paid).

Subordinate Debt Pricing

Subordinate debt terms are influenced by property-specific considerations (asset quality, geographic location, level of stabilization, net income, debt service coverage, etc.), along with senior lender requirements, state foreclosure laws, the composition and amount of borrower equity, and the experience and resources of the borrower principals.

As noted earlier, the yield on a B-note is generally the result of negotiations between the A- and B-note holders. The relative yields will be heavily influenced by the debt service coverage ratios, as well as the attachment and detachment points (the LTV ratios where the B-note starts and stops) and the relative debt yields (lender implied cap rates) at each of those levels.

Mezzanine debt and preferred equity can be priced with a full pay structure, or a pay and accrue structure (whereby the difference in the total return and the current required payment accrues to the balance and is due at maturity). Pay rates for B-notes and mezzanine loans can be fixed or floating, but are most commonly fixed rate, and there may be an upfront origination fee.

Long-term fixed-rate B-notes and mezzanine loans average 75% LTV detachment points at low/mid-teens interest rates with no origination fee (par pricing) or a small (1 point) fee. These longer fixed-rate loans are often attached to 10-year CMBS loan originations and are not typically leveraged with additional lender debt. Floating rate mezzanine loans can stretch to 85% LTV and generally price at 30-Day Average SOFR plus a spread that achieves a high single-digit to low double-digit returns, further enhanced to the mid-teens by fund-level warehouse/repo financing structures.

Preferred Equity interest rates vary based on the risk profile of the underlying property, the leverage point and the financial structure. Current pay rates are frequently 6% to 10%, with all-in accrual rates 13% to 15% for stabilized properties. Pre-stabilized properties and construction / development loans may have subordinate financing rates ranging around 20%.

Call Protection

Subordinate debt structures generally include some form of call protection, which are additional charges due when the borrower/sponsor decides to repay the obligation earlier than the stated term. These provisions protect the lender’s interest by requiring a minimum yield or profit in the event of an early payoff.

Generally, mezzanine loans can only be prepaid in conjunction with the senior loan, whereas preferred equity can often be repaid while the existing senior loan remains in place. As a result, the likelihood of prepayment of preferred equity is relatively higher than for mezzanine loans.

Because call protection represents profits earned earlier than anticipated, it can have the effect of creating outsized returns (increases IRR).

Call protection for B-notes and mezzanine loans can take several forms including:

- Fixed Prepayment Penalties – either a specified minimum number of months of interest or a fixed percentage of the loan balance.

- Step-Down Prepayment Penalties – similar to a fixed penalty, but the penalty percentage decreases over time.

- Yield Maintenance – this is calculated by solving for the present value of future interest the lender would have collected if the loan were paid through to the end of the prepayment penalty period.

- Defeasance – This structure may be used by various lenders but can be common in CMBS transactions. Bond coupons utilize the underlying mortgage interest payments as the generator of returns. Defeasance as a prepayment mechanism refers to a collateral replacement where the lender agrees to release the property in exchange for a basket of government-backed securities that maintain the stated rate of return for the lender. In a falling interest rate environment, this can make early prepayment very expensive and even prohibitive for borrowers. In a rising rate environment, the penalty reduces since lenders can redeploy prepaid capital at improved yields.

Preferred equity call protection takes the form of a minimum amount of interest or minimum profit multiple, with the prepayment penalty often calculated as the remaining amount required to provide the lender with an overall return equal to 1.40x to 1.50x their original invested capital. When such prepayments occur within the first few years, they serve to increase the lender’s IRR above the original low/mid-teens expectation.

Equity

REIT Shares

Real estate investment trusts (REITs) are companies that own, operate or finance real estate. Most, though not all, REITs focus on income-producing real estate. REITs can be both public or private. Public shares can be purchased on a stock exchange.

- Equity REITs – Equity REITs are direct owners of real estate. The majority of REITs fall into this category.

- Mortgage REITs (“mREITs”) – provide financing for real estate. mREITS purchase or originate mortgages and/or related securities and earn income from the interest on these investments.

- Public Non-Listed REITs – Public, non-listed REITs are registered with the SEC but do not trade on national stock exchanges.

- Private REITs – Private REITs are offerings that are exempt from SEC registration and whose shares do not trade on national stock exchanges.

Public REIT investments provide the opportunity to invest in real estate while mitigating many of the risks associated with traditional direct investment (illiquidity, high unit value and transaction costs).

The benefits to REIT investment (particularly public REITs) include attractive dividend yields (REITS are required to distribute 90% of their taxable income to shareholders) and liquidity (when compared to direct ownership). The disadvantages to REITs are that their prices can at times respond to factors other than the underlying real estate fundamentals of the private leasing and transaction markets. This is particularly true since REITs constitute portions of other ETF and index funds with broader themes. As an example, REIT holdings could be broadly reduced within portfolios by a shift in investor sentiment from value to growth, causing REITs to be undervalued relative to the private real estate markets. Of course, the reverse scenario can also occur where REIT prices may become significantly undervalued relative to private transaction prices.

Direct Investment

Equity investments (direct property ownership) is common in the private real estate market. Such investments can be solely owned, syndicated, or owned through a joint venture, private REIT or limited partnership. Equity investors in the private market own the property and thus need mechanisms for control of day-to-day management and major decisions including financing, asset management and exit strategies. Owned properties are most often financed with mortgage debt, typically averaging 65% of property value (generally ranging from 50% to 80% LTV).

Direct sponsorship often requires a larger minimum financial commitment than public market investment, since owned properties can be of significant scale, indivisible and less liquid. This is a major reason why investors may benefit from structures designed to pool resources to create access and enhance diversification within private markets such as single property syndications, private REITs or Fund limited partnerships. To comply with securities laws, these types of investments, which are inherently less liquid than public REITs, are generally limited to accredited investors. Additionally, direct private investment requires active management, so the expertise of the lead investor and/or property/asset managers are an important factor in the outcome of the investment.

Low Volatility

Real estate investment offers the potential for superior risk-adjusted returns compared to some other major asset classes. The chart below compares the average total annual returns and standard deviation of returns for the period from 2010 through 2023.

Annual Total Returns, 2010-2023

Among the group of assets listed, stocks have achieved the highest average returns for the period, followed by Public REITs. However, both asset classes have more volatile returns, with standard deviations higher than their average returns for the period.

Real estate private equity, and high-yield real estate private debt have the next highest returns amongst the asset classes shown here, at 8.5%, and 8.4%, respectively. Both asset classes have lower standard deviations than stocks and Public REITs.

We did calculate and review Sharpe ratios associated with this data set. However, we concluded that due to the volatility of the period from 2010 to 2023, the ratios weren’t as reliably robust as we would like to see. However, based on a more simplified comparison of relative risk adjusted returns, we find that high yield real estate private debt compared favorably to competing asset classes. Bonds have had the most difficult experience during the referenced timeframe. In other words, the average returns for the high-yield commercial real estate debt asset class were higher than the standard deviation of its returns for the time period. The simple ranking of risk-adjusted returns by sector is shown below:

Ranking by Risk-Adjusted Returns

- High Yield CRE Private Debt (Mezzanine, B-Notes, Preferred Equity, Leveraged Loans)

- Real Estate Private Equity

- Equities (Stocks)

- High Yield Bonds

- Public REITs

- CRE Private Debt (Mortgage Loans)

- CMBS

- Bonds (Aggregate)

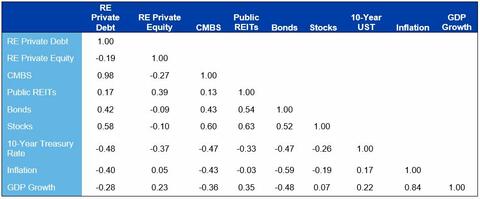

Diversification

Real estate investment can offer diversification benefits to investors with multi-asset portfolios. The table below shows the correlation of returns for several real estate investment types as they relate to other major asset classes. A correlation of 1.00 means perfect correlation, whereas a number less than 1.00 shows a lesser correlation, and a negative number means the correlation goes in the opposite direction (toward non-correlated). The real estate investment returns all have relatively low (or even negative) correlations to other major asset classes. Additionally, correlations between the different types of real estate investments are also relatively low, meaning that multiple entry points into the real estate capital structure can be utilized in a diversified portfolio.

Income Returns

One of the most attractive characteristics of real estate debt is its relatively predictable stream of income. The typical payment structure of real estate loans offers cash flow streams that are greater than an investor would receive with equity positions or many corporate bonds.

Sources: Giliberto-Levy (Real Estate Private Debt and High Yield Real Estate Private Debt), LCG Associates (Bonds), NCREIF (Real Estate Private Equity), Bloomberg Aggregate Bond Index (Bonds), NAREIT (REITs), Stocks (Russell 3000)

Conclusion

According to the Federal Reserve, commercial real estate is a $21.8 trillion asset class. A market of such size and scope is deserving of greater focus, particularly from individual investors and defined contribution plans who have not previously maintained allocations commensurate with their exposure to the larger U.S. $64.4 trillion public equities market and $60 trillion fixed-income ($46.3 trillion non-CRE and $13.8 trillion CMBS and ABS) markets. Large portions of the private CRE markets outside the top 25-50 U.S. metro areas, as well as product types beyond the four main food groups of office, industrial, retail and multifamily, are not covered by public REITs. To access alternative yield, increased diversification, and reduced correlation, investors would do well to consider an allocation to private real estate generally. More specifically, investors with existing exposure to the largest markets and most common properties may benefit from considering new markets and properties that have the potential to further enhance the favorable features of investments in commercial real estate.

©Northmarq Fund Management Research, February 2025. All Rights Reserved. Copying, selling or otherwise distributing copies and/or creating derivative works for commercial purposes is strictly prohibited. Although significant efforts have been made in preparing this paper, Northmarq Fund Management Research makes no representation or warranties with respect to the accuracy and completeness of the contents. Northmarq Fund Management Research does not provide tax, legal, investment or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied upon for, tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.

Read More

Insights

Research to help you make knowledgeable investment decisions