Why Medical Office Buildings Are a Reliable Bet in CRE Today

MOBs Move from Niche to Core

Medical outpatient buildings (MOBs), or medical office buildings, were once considered a niche of the office sector. Now they have moved from a niche strategy to a must-have in diversified portfolios. Investors are drawn to their durable income streams, long lease terms and resilience against broader office volatility.

As of second quarter 2025, average MOB occupancy reached 93.5% within the top 125 markets, as recorded by Revista, with absorption totaling more than 15.9 million square feet across these same markets. New development pipelines remain constrained, due to increased construction costs and higher interest rates, fostering conditions in which demand continues to outpace supply. In 42 of the 125 markets tracked, occupancy rates for medical office buildings are 95% or higher. As a result, we are seeing year-over-year rental rate increases exceeding 2% within those markets.

What Sets MOBs Apart

Long Leases Backed by Costly Buildouts

Healthcare tenants often commit to seven- to 10-year leases. Imaging suites, surgical rooms and specialized air and fluid handling systems are expensive to build, making relocation disruptive. For investors, this translates into lower turnover and more predictable income streams.

Durable Tenancy

Hospitals, health systems and large physician groups anchor many MOBs. These organizations remain financially strong, and their operations are essential, giving medical office owners a stable tenant base.

Supply Constraints

New medical outpatient building development accounts for only about 1% of total inventory. Regulatory complexity, high construction costs and limited financing have slowed ground-up projects, creating tighter competition for existing properties.

Key Investor Considerations in 2025

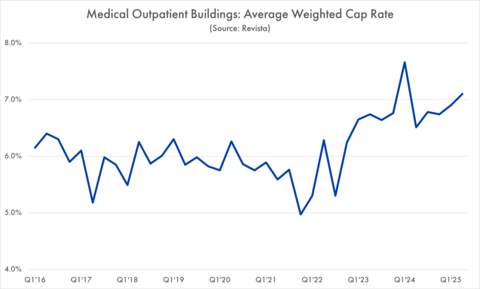

Pricing and Capital Costs

While fundamentals remain sound, capital costs and pricing continue to create divergence. On-campus, Class A assets are trading competitively, while off-campus medical office and secondary assets face more repricing pressure.

Conversions on the Rise

Office-to-medical and retail-to-medical conversions are growing to meet healthcare demand. Success depends on structural capacity, MEP systems and regulatory approvals, making careful due diligence essential.

Outpatient Care Growth

Healthcare delivery is shifting toward outpatient settings. Volumes are expected to rise over the next decade, fueling demand for accessible, tech-enabled MOBs. Properties near suburban corridors with strong patient access may see outsized gains.

Location Still Matters

Performance is strongest in high-growth metros near major health systems or along suburban medical corridors. Recent trends highlight Washington, D.C., Chicago, Minneapolis-St. Paul and Tucson for recent sales.

Investors are also paying close attention to regional performance. Sunbelt markets like Houston, Atlanta and Phoenix continue to attract both patients and providers thanks to population growth. Coastal hubs, such as Boston and Philadelphia, benefit from strong academic medical systems, while Midwestern metros like Minneapolis-St. Paul and St. Louis have shown consistent absorption supported by stable health systems. These regional differences highlight why localized market knowledge is essential for MOB investment.

Demographic Drivers of MOB Demand

One of the most durable tailwinds for medical office building investment is the aging U.S. population. By 2030, one in five Americans will be over 65, according to the Census Bureau. This demographic shift directly increases demand for outpatient services like primary care, cardiology and oncology. At the same time, younger generations are pushing for more convenient, tech-enabled care options, creating steady demand for medical outpatient facilities located in suburban corridors and retail-adjacent sites. For investors, these demographic forces reinforce why MOBs are positioned for long-term occupancy stability and NOI growth.

Real Transactions Illustrating Northmarq’s Execution Power

Northmarq’s track record demonstrates how specialized underwriting and healthcare capital expertise translate into results.

Riverview Health Portfolio, Indiana

Northmarq arranged the $13.5 million sale-leaseback of two outpatient MOBs totaling nearly 33,000 square feet. With long-term triple-net leases in place and Riverview Health’s strong credit profile, this transaction emphasized the demand economics for clinic space within the market, achieving a price of $409 per square foot. This structure delivered liquidity to the provider while giving the buyer a reliable, long-duration income stream.

ChenMed Primary Care, St. Louis

Northmarq represented the seller in a $4.4 million disposition of a 14,000-square-foot medical office building while simultaneously securing $2.8 million in permanent financing for the buyer. This dual execution demonstrates how Northmarq’s integrated platform aligns capital sourcing with investment sales, simplifying the process for clients.

Texas Oncology, Bastrop, TX

A complex oncology-focused MOB required collaboration between Northmarq’s National Healthcare Group and Net Lease team. The result was a five-year loan structured at competitive terms, satisfying both sale price expectations and the provider’s capital needs. The National Healthcare Group was able to demonstrate the market share of oncology services controlled by the tenant, as well as forecast demand for oncology services, as part of the underwriting of the investment. This illustrates how specialized medical office underwriting benefits from understanding service-line durability and payor mix.

Northmarq’s Underwriting Strategy

Our National Healthcare Group brings a healthcare first lens to underwriting and strategy. We go beyond traditional real estate analysis by:

- Integrating healthcare data into underwriting – layering payor mix, provider growth and service-line durability into every evaluation, not just tenant credit.

- Informing site selection with healthcare demand signals – incorporating demographic shifts, telehealth adoption and patient flow data to identify markets where provider demand outpaces supply.

- Providing access to specialized capital – connecting clients with healthcare-focused lenders and equity partners who understand MOB fundamentals.

- Unlocking value for owners – identifying adaptive reuse opportunities, optimizing tenant specialties and advising on conversion when they meet both healthcare and real estate requirements.

Leveraging Deep Data: A Conversation with Toby Scrivner

Northmarq’s healthcare-first approach is rooted in data. In a recent feature, A Conversation with Toby Scrivner, Scrivner explains how the National Healthcare Group began layering payor mix, provider expansion strategies, specialty practice data and demographic shifts into underwriting years before it became an industry standard.

This forward-thinking lens allows Northmarq to anticipate market movements, advise clients on where outpatient demand will grow fastest and structure deals that account for reimbursement risk.

Final Thoughts

Medical outpatient buildings continue to distinguish themselves in a shifting CRE landscape. With occupancy near historic heights, limited new development and steady outpatient growth, MOBs provide a rare combination of income stability and long-term upside. Success in 2025, however, requires more than recognizing those fundamentals. It demands data-driven underwriting, disciplined capital alignment and a clear strategy for asset quality.

Ready to Evaluate a Medical Office Strategy?

Northmarq’s National Healthcare Group can help you:

- Underwrite MOBs using healthcare-specific data, from payor mix to service-line durability

- Identify metros where patient demand and reimbursement trends support NOI growth

- Source debt and equity from healthcare-savvy capital providers

- Screen conversions and adaptive reuse for feasibility before committing capital

- Align loan structures with rollover, TI and provider growth strategies

Connect with a Northmarq advisor to explore how medical office buildings can enhance your portfolio.

Insights

Research to help you make knowledgeable investment decisions