San Antonio Q2 Multifamily Market Report: Cap Rates Compress as Sales Velocity Accelerates

Highlights:

- Renter demand for apartment properties in San Antonio has been on the rise in 2021, pushing vacancy rates lower and driving rents higher. Construction remains active as developers move projects through the pipeline to meet demand.

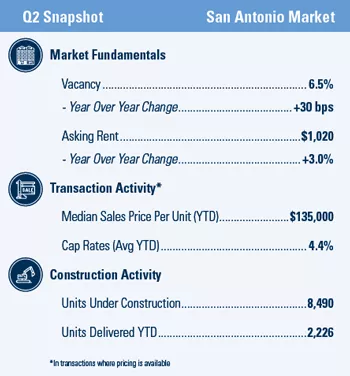

- Vacancy dipped 10 basis points in the second quarter, following an identical decline in the first three months of this year. Despite the improvement in 2021, the current vacancy rate of 6.5 percent is 30 basis points higher than the figure from one year earlier.

- After holding steady for the past several quarters, the pace of rent growth surged in the second quarter. Asking rents rose 3 percent in the second quarter, reaching $1,020 per month. The recent gains pushed annual asking rent growth up to 3 percent.

- Sales velocity in the local multifamily market gained momentum during the second quarter, with transactions picking up by nearly 30 percent. In transactions where pricing information was available, the median price has reached approximately $135,000 per unit, while cap rates have compressed to 4.4 percent.

Related Articles

Insights

Research to help you make knowledgeable investment decisions