NorthMarq finalizes $16.2 million refinance of two mixed-use properties in Princeton, New Jersey

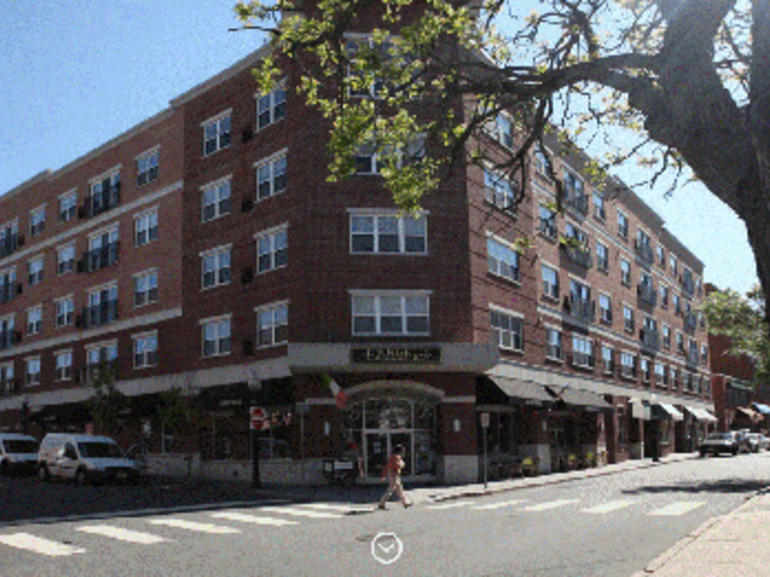

MORRISTOWN, NEW JERSEY (April 23, 2021, 2021) – NorthMarq has announced the $16.2 million refinancing of two mixed-use buildings in Princeton, New Jersey. Each property is 5-stories with ground floor retail that total 92,359 rentable sq. ft. The properties are located at 25 Spring Street and 55 Witherspoon Street within the prominent downtown area of Princeton, New Jersey. 25 Spring Street is a 60,410 sq. ft. property with three ground floor retail tenants and 52 luxury apartments. 55 Witherspoon consists of 31,949 sq. ft. with two ground floor retail tenants and 24 units.

The former use of the ground that sits under the subject properties was surface parking lots owned by the Borough of Princeton. Under the state redevelopment laws, the Borough formed a public-private partnership in 2003 with Nassau HKT Associates. A 99-year, un-subordinated ground lease was entered into with the first portion of the redevelopment including construction of the 55 Witherspoon building, a 15,000 sq. ft. public plaza, a 500-car public parking garage and a new 58,000 sq. ft. building housing the Princeton Public Library. The 25 Spring Street building was then redeveloped on a second Borough parking lot across the street from the 55 Witherspoon building.

“The ownership group requested a long-term fixed rate loan and we were able to arrange a15 Year term at a rate substantially below 3 percent. The deal had a number of interesting facets including an unsubordinated ground lease, expiring PILOT and retail tenants who are paying 50 percent of their rent due to the pandemic,” said Gary Cohen, managing director of NorthMarq’s New Jersey office. The lender, Principal Financial, was fantastic to work with and were able to get comfortable with the deal and provided an excellent execution.