Northmarq secures acquisition value-add financing for 8-building industrial park in Houston

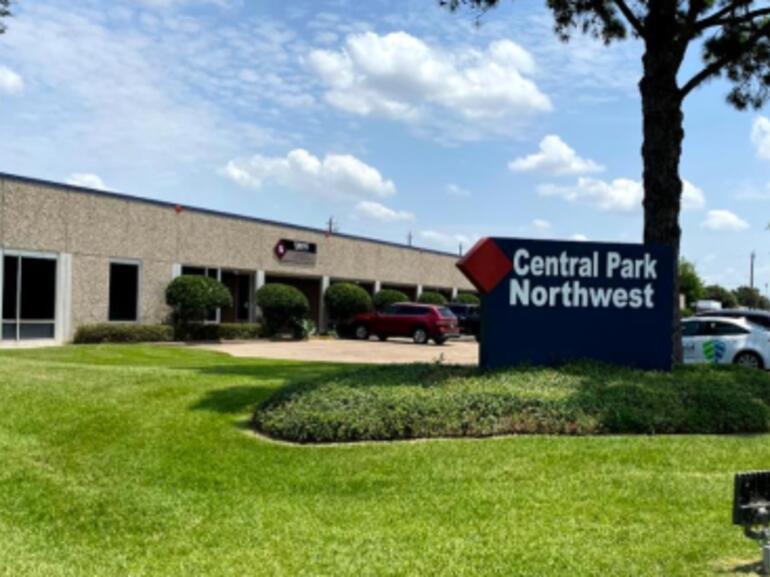

HOUSTON — Northmarq’s Houston Debt + Equity team has secured acquisition financing for Central Park Northwest, an eight-building, 293,743-sq.-ft. flex/light industrial business park in Northwest Houston.

Managing Director Warren Hitchcock and Vice President Taylor Phillips arranged the value-add acquisition financing on behalf of the buyer team, led by Exline Capital and Moody Rambin, structured as a fixed rate loan with future fundings for the value-add CapEx and TILC costs.

“It was our pleasure to add value to the Exline Capital and Moody Rambin teams by procuring the financing for this excellent value-add acquisition. It was a true team effort.” Hitchcock said. “Ultimately, we had many competitive financing options on this opportunity due to the strong in place cash flow, mark-to-market value-add opportunity, extremely infill location, and strong sponsorship. In today’s market this combination of cash flow and upside generated excellent terms and fixed rate with a 5% handle.”

Located near the Highway 290/Loop 610 interchange, Central Park Northwest offers strategic connectivity to Houston’s major employment centers and distribution corridors — a key advantage for logistics, last-mile delivery and small-scale industrial users.

The property features suites averaging 4,100 square feet, a size category that is increasingly sought-after in Houston’s tight industrial market.

With its functional layout, infill location and solid market fundamentals, Central Park Northwest is well-positioned to benefit from sustained investor and tenant interest in Houston’s thriving industrial sector.