NorthMarq’s San Francisco office secures $9.3 million acquisition financing with Freddie Mac for multifamily property in Athens, Georgia

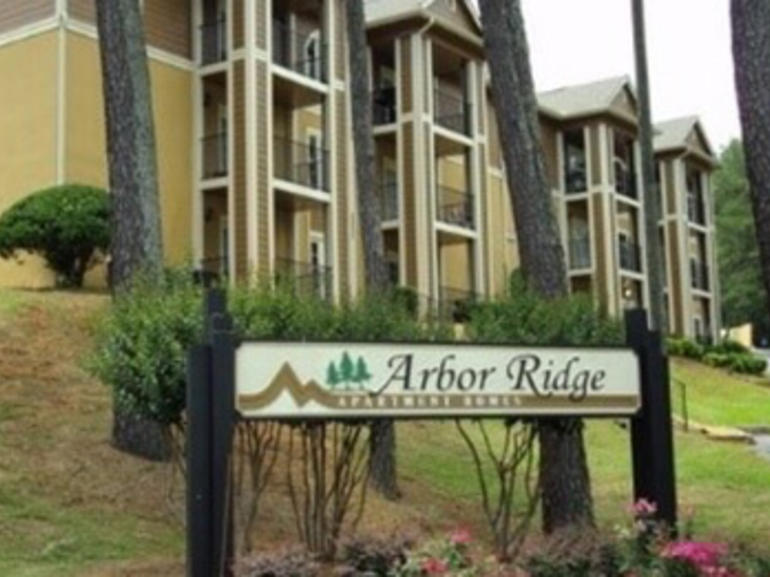

SAN FRANCISCO, CALIFORNIA (January 14, 2019) – Andrew Slaton, vice president and Griffin Whitlock, investment analyst in NorthMarq‘s San Francisco office arranged the $9.3 million acquisition financing for Arbor Ridge Apartments, a 212-unit multifamily property located at 150 Chateau Terrace in Athens, Georgia. The 7-year floating-rate loan was structured with full-term interest-only. NorthMarq arranged financing with Freddie Mac for the borrower, an entity controlled by Asia Capital Real Estate (ACRE).

Arbor Ridge was built in 1969 and partially renovated by the seller in 2008. The borrower is purchasing the property with plans to renovate common areas and unit interiors over the next couple years. The property is located three miles west of downtown Athens and in close to many major employers. The property is also convenient to the University of Georgia and its location adjacent to Highway 78 allows for quick access to downtown Athens’ numerous dining, retail and entertainment options.

Amenities such as a clubhouse, fitness center, laundry facility, playground, pool, courtyard, tennis court, and business center are offered at the property and enhance its competitiveness. Unit amenities include private balconies, fully equipped kitchens, dishwashers, washer and dryer connections, energy efficient windows, and oversized closets.

“This was a quick close that overlapped with the holiday season and all parties collaborated well to close the transaction before the end of the year,” said Slaton. “Freddie Mac’s 7-year floating rate program fit well with the borrower’s business plan and the ability to do full-term interest only allows the borrower maintain healthy cash flow while they execute on value-add renovations. ACRE is a valued client and capable sponsor and we look forward to seeing them update the community and improve operations.”

About Asia Capital Real Estate (ACRE)

Asia Capital Real Estate (“ACRE”) is a real estate investment firm, managing discretionary capital on behalf of private and institutional investors with offices in New York, Atlanta, Florida, and Singapore. ACRE focuses on private equity and debt real estate investments primarily in the U.S. Distressed and Value-Add Multifamily market, with regional concentration in the Southeastern and Midwestern United States.

Through a series of private equity funds, ACRE provides investors access to its U.S. real estate platform, comprised of proprietary fund and asset management services which include new acquisitions, tax & legal structuring, debt origination, construction & refurbishment and property management services.

ACRE manages over $1 billion of AUM invested across 10,000+ apartment units of existing product, as well as special situations that include ground up development. For more information, please visit asiacapitalrealestate.com.

Northmarq is a full-service capital markets resource for commercial real estate investors, offering seamless collaboration with top experts in debt, equity, investment sales, loan servicing, and fund management. The company combines industry-leading capabilities with a flexible structure, enabling its national team of experienced professionals to create innovative solutions for clients. Northmarq's solid foundation and entrepreneurial approach have built an annual transaction volume of more than $39 billion and a loan servicing portfolio of more than $76 billion. Through the 2022 acquisition of Stan Johnson Company and Four Pillars Capital Markets, Northmarq established itself as a provider of opportunities across all major asset classes. For more information, visit: www.northmarq.com.