September Economic Commentary: Impact of Fed’s tightening begins to show

Senior Investment Advisor

Pohlad Companies

During the month of August, declining economic strength and momentum became more apparent with nearly every economic report that was released. The impact of the Fed’s moves to slow demand are only beginning to be realized, however, and based on recent statements from multiple Fed officials, they do not anticipate changing their ongoing tightening of monetary policy anytime soon.

Consumer Metrics

In early August we received the report on the Consumer Price Index (CPI) for July. Headline CPI was unchanged during July and brought the year-over-year CPI down from 9.1% to 8.5%. Declining energy prices were a big reason for the flat reading of CPI. Further weakness in the monthly reading of the CPI is expected as gasoline has now declined 25% since its high in June. Stripping out the impact of food and energy, the Core CPI increased 0.3% in July, which was a 10-month low, and remained at 5.9% year over year.

Subsequent to the CPI report, the July Producer Price Index (PPI) saw a softening in the prices paid portion of the report that reflected the decline in commodity prices as well as improvements in supply chain bottlenecks. The softening in prices paid has historically been a reliable precursor of declines in the CPI during the coming months.

Retail sales for July were unchanged, and June’s report was revised down slightly from 1.0% to 0.8%. As with the CPI report, the decline in energy prices weighed on the overall number. Receipts for gasoline sales were down 1.8%, which meant that the consumer had more to spend on other items, enabling spending on goods to hold up better than expected during July.

The U.S. Leading Economic Indicators fell for the fifth consecutive month and are unchanged on a year-over-year basis. Year-over-year readings below zero have historically been associated with recessionary periods.

Employment

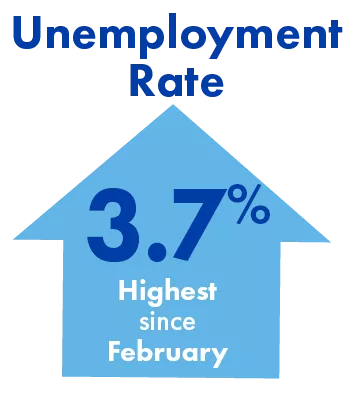

The employment report for August showed non-farm payrolls improving by 315,000 but slowing from the revised July report that indicated an increase of 526,000. The unemployment rate moved up to 3.7% from 3.5%, its highest reading since February. The increase in the unemployment rate was due to the fact that the participation rate improved (more people joining the workforce) while jo bs added were less than the number of new entrants. Average hourly wages rose 0.3% (the weakest increase since February) suggesting that wage pressures are easing and supply and demand in the labor market are gradually getting into balance.

Perhaps more interesting in the employment report were some numbers that were not widely discussed. First there were downward revisions of 107,000 to the prior two months reports. Secondly, there has been a steady decline in the average workweek hours this year to 34.5 hours – the lowest since April 2020. Finally, the Household survey (used to determine the unemployment rate) showed that full-time jobs contracted by 242,000 (the third consecutive month of contraction), part-time workers increased by 413,000, and those holding multiple jobs increase by 114,000 – not something seen in a strong labor market.

Fed Actions

The weakening tone of the economic reports this summer has led some to speculate that the Fed may be preparing to pivot from tightening their monetary policy to something more accommodative. At the Fed’s annual policy symposium at Jackson Hole in late August, Chair Powell, in no uncertain terms, made it clear that “Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.” He added, “While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to household and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.”

Currently, markets are pricing in a 1.25% increase in the Fed Funds rate by the end of the year that would bring the rate to 3.75%. At the same time, the Fed is increasing its Quantitative Tightening (QT) program by reducing its balance sheet holdings by $95 billion per month starting now.

In short, the Fed is committed to bringing supply and demand back into balance and thus reducing the elevated inflationary pressures we are experiencing. As a result, the Fed is tightening monetary policy in an economy that is already weakening. Consequently, the pathway for the Fed to achieve their desired soft landing for the economy is becoming increasingly narrow.

Insights

Research to help you make knowledgeable investment decisions