Nashville Q4 Market Insights: Developers active, particularly in Downtown Nashville

Highlights

Image

- Operating conditions in the Nashville multifamily market softened during the fourth quarter as absorption levels dropped, vacancy rose, and asking rents ticked lower. Apartment developers remain active as both the annual delivery total for 2022 and the construction pipeline reached cyclical highs in recent months.

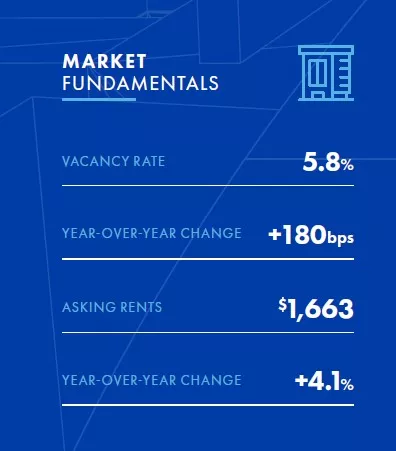

- The vacancy rate trended higher for its fifth consecutive quarter, rising 60 basis points in the last three months. The rate increased 180 basis points in 2022 to 5.8 percent.

- After a sharp decline in the third quarter, local asking rents inched lower in the final three months of the year, dropping less than 1 percent to $1,663 per month. Despite the recent declines, average rents rose 4.1 percent for the full year.

- The multifamily investment market slowed at the end of the year with investors trading fewer properties than in recent quarters. The median sales price through the end of 2022 was $235,400 per unit, up 33 percent from the median price in 2021.

Related Articles

Insights

Research to help you make knowledgeable investment decisions