May Economic Commentary: Fed takes action as inflation indices approach historical highs

Chief Economist

Pohlad Companies

The war on inflation by the Federal Reserve has begun in earnest. At their May 4 meeting the Fed announced an increase of the Federal Funds rate by 50 basis points (bp) in conjunction with the initiation of the shrinking of their balance sheet. The Fed’s actions have been anticipated for several weeks as inflationary pressures continue to build and a decisive plan by the Fed was needed to maintain their credibility as inflation fighters. The Fed’s actions are focused on slowing the demand side of economic activity, but the supply side of the economic equation also continues to aggravate inflationary pressures.

The Consumer Price Index (CPI) for March indicated inflation was increasing at an 8.5% year-over-year rate, the highest rate since December 1981. Other inflation indices are registering comparable historical highs as well. The biggest driver of inflation in March was gasoline prices – up 18.3% during the month. The path of future inflation is being complicated by the Ukrainian situation.

Disposable Income and Personal Savings

Real disposable personal income is down 19.9% year over year, and we are starting to hear reports of a consumer spending slowdown from various corporations as they report their 1Q-22 results. Real personal spending is growing at the slowest rate (+2.3%) in more than a year. The personal saving rate is now at 6.2%, the lowest savings rate since December 2013. Consumer balance sheets remain in relatively good shape, however, with debt service payments near 40-year lows.

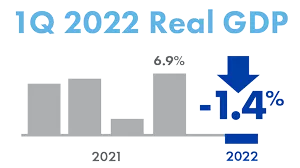

GDP

The initial reading of 1Q-22 Real GDP was reported to be -1.4% annualized, down from a +6.9% reading in 4Q-21, primarily caused by a large drop in exports and a significant slowing in inventory growth. The slowing in inventories was expected after a strong 4Q-21 reading that was the primary support of the 6.9% 4Q-21 reading.

Productivity in 1Q-22 recorded the weakest reading since 1993. Year-over-year productivity was reported as negative 0.6%. This is not surprising when you have a quarter of negative Real GDP growth coupled with a strong labor market (as we’ll see below). More workers but less output is the definition of weak productivity. Corresponding to the weak productivity number was the 40-year high in the growth rate of unit labor costs (+7.2%). These factors are contributing to higher inflation.

Payrolls and Unemployment

The labor market remains strong with non-farm payrolls increasing by 428,000 in April. The unemployment rate remained unchanged at 3.6%. The labor force participation rate fell from 62.4% to 62.2% as the labor force contracted by 363,000. The lack of labor supply remains a challenge for employers and is helping to keep wages elevated. Strong wage growth coupled with weak productivity will keep the Fed raising rates in order to slow the economy and associated inflation pressures. The strong labor market enables the Fed to be aggressive in tightening monetary policy without worrying about increasing unemployment for now as there are 1.9 jobs available for every unemployed person.

Fed Funds Rate

As mentioned at the outset, the Fed is responding to the highest inflationary pressures of the last 40 years by increasing the Fed Funds rate and beginning to reduce the size of its balance sheet. The combination of these two strategies have never been used in a high-inflationary environment such as we have today, and at a time that the overall economy is already starting to slow. In addition to the 50-bp increase in the Fed Funds that was implemented last week, the Fed is expected to increase the Fed Funds rate by another 50 bp at each of their next two meetings (June 15 and July 27). Markets are pricing in additional increases of 25 bp at each of the remaining meetings this year, which would bring the Fed Funds upper target to 3.00% by the end of the year. Such an upward move in the Fed Funds rate in addition to the ongoing unwinding of the Fed’s balance sheet would definitely cause the economy to slow. It is unknown whether the Fed will pull back from this tightening strategy if the economy weakens more than expected, or if they will continue to fight the war against inflation regardless of the cost. Fear that the Fed may make a policy mistake at this important juncture is the source of the present volatility we’re seeing in markets today.

As stated before, with no fiscal relief in sight, a tightening monetary policy, and slowing growth, the Fed’s challenge to engineer a soft landing for the economy is fraught with execution risk.

Insights

Research to help you make knowledgeable investment decisions