July Economic Commentary: Uneven progress as some metrics improve while others face headwinds

Chief Economist

Pohlad Companies

The ongoing strong support from monetary and fiscal policy coupled with the continued progress on vaccinations for COVID-19 is resulting in improved economic activity and employment as we move into the third quarter of 2021. The sectors of the economy most negatively impacted by the pandemic remain challenged but are showing improvement. The imbalance between demand and supply in many areas of the re-opening economy is resulting in increased inflationary pressures whose persistence is the subject of ongoing debate. The following discussion of recent economic reports illustrates the uneven progress associated with the re-opening of the economy.

Inflation

Starting with inflation, the recent reports, not surprisingly, reported elevated readings. The year-over-year Consumer Price Index (CPI) is 5.0% (the strongest reading since 2008). The categories most sensitive to the re-opening of the economy (rental cars, airfares, used cars, and lodging) accounted for the majority of increased price pressures. This suggests that this surge in inflationary pressures is largely transitory and will diminish as supply and demand come back into balance.

Although viewed as transitory, inflationary pressures are likely to persist longer than initially expected. A report from the manufacturing sector indicates that the index of input prices for manufactured goods is at the highest level since the 1970s. Despite some early signs that shortages and bottlenecks may be starting to ease, delivery times and order backlogs remain high. These challenges are expected to continue for some time.

Retail Sales

The month-to-month growth of retail sales has slowed after the stimulus-supported surge in the early spring. The actual level of retail sales remains elevated, but the slowing of their growth rate suggests that consumers are starting to shift their spending from goods to services (not picked up in retail sales) as the economy re-opens.

Housing Market

The housing market remains hot. Year-over-year home prices are increasing the most since 1988 (+14.6%) according to the recent Case-Shiller Index. Low interest rates and insufficient supply are supporting this market.

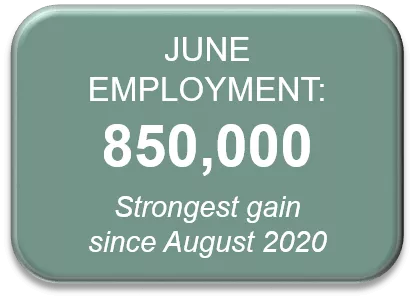

Employment

The June employment report showed a gain of 850,000 in non-farm payrolls—the strongest monthly gain since August 2020. Payrolls are still 6.8 million lower than February 2020, however. The unemployment rate ticked up to 5.9% from 5.8%. The labor force is 3.4 million below the pre-pandemic level. Two million of the shrinkage in the labor force is due to retirements, and the remainder is viewed as reticence to return to work for varying reasons. It is hoped that with school starting, continued vaccinations, and the end of extended unemployment benefits in September that participation will improve. With job openings at record levels, however, other factors such as skills mismatches are coming into play. All of this suggests that upward wage pressures should be expected.

GDP

The Federal Open Market Committee (FOMC) met in mid-June and kept current monetary policy unchanged. Minutes from that meeting indicate that the Fed now expects economic growth to be stronger in 2021 than their previous forecast (GDP at +7.0% vs. +6.5%), and inflation to be higher by 4Q-2021 (+3.0% vs +2.2%). Their forecasts for inflation in subsequent years increased by only 0.1%, however, indicating their ongoing belief that the current inflation surge will be transitory. They remain focused on promoting maximum employment. While improving, employment is not progressing as quickly as hoped. Looking ahead, the Fed’s median interest rate projection now shows two rate increases in 2023. Previous projections showed increases starting in 2024. Discussion of plans regarding the tapering of asset purchases will begin in upcoming meetings.

The bond market appears to be agreeing with the Fed that current inflationary pressures are transitory. Ten-year Treasury yields have dropped from 1.74% in late February to 1.30% today.

Looking Forward

To sum it up, the economy is improving overall but bottlenecks in the supply chain and the slow progress in the labor market are headwinds to economic growth reaching its full potential. These headwinds are not likely to be resolved in the near term. Economic growth probably peaked in the second quarter. Although GDP growth for the year is still projected to be the strongest since 1984, the trend toward slower growth in coming quarters is becoming evident.

Insights

Research to help you make knowledgeable investment decisions