February Economic Commentary: Stage is set for economic growth, but virus still poses a risk

Chief Economist

Pohlad Companies

The U.S. economy ended 2020 on a soft note with the resurgence of the virus in the fourth quarter, the expiration of many government support programs, and the establishment of new restrictions on activities in parts of the country. The stage appears to be set, however, for stronger economic growth in 2021. The ramping of vaccinations, the slowing of the virus, new government stimulus, and the eventual curtailment of restrictions suggest that there will be opportunity in the second half of the year for consumers to spend a portion of their inflated savings to satisfy pent-up demand and, thus, re-accelerate economic growth.

Fourth-Quarter GDP

The initial reading of 4Q-20 real GDP was reported at +4.0% annualized. For the year, real GDP declined 3.5%, the weakest calendar year performance since 1946. Personal consumption expenditures, representing more than two-thirds of GDP, were negatively impacted in 4Q-20 by the factors mentioned in the opening sentence. The lack of momentum heading into 2021 suggests that 1Q-21 will be the weakest quarter of 2021, but the impact of the $900 billion stimulus package should start to be felt in the first half of the year. Any additional stimulus packages will only increase the potential spending power that may be unleashed once the virus is under control.

Employment

January’s employment report was weaker than expected on various fronts. Payrolls grew by only 49,000, and the private sector only grew 6,000. The two previous monthly reports were revised downward by a total of 159,000 jobs. The areas of the economy that had been showing strength (construction, manufacturing, motor vehicles, health care and social assistance) all showed losses. From the February peak of 152 million payroll jobs to the 130 million level in April, payrolls have now stabilized around 142 million since September. The lack of progress in the labor market is concerning.

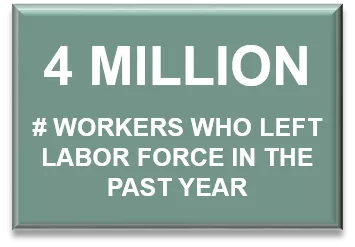

The unemployment rate declined to 6.3% from 6.7% due to a reduction in the size of the labor force of 406,000 while 201,000 jobs were added. The participation rate is 61.4%, down from 63.3% in February. If the participation rate had stayed at the February level of 63.3%, the unemployment rate would be 9.0%. Over 4 million workers have left the labor force since February. Another 4 million workers are classified as long-term unemployed (looking for work for more than 27 weeks). Until these workers reconnect with the labor force, there is risk of permanent impairment to the labor market.

Industrial Production

Industrial Production has continued to recover. Production is catching up with the more rapid recovery in spending for goods. While restrictions are weighing on service sector activity, manufacturing has been a bright spot and is likely to remain so with customer inventories now at the lowest levels since 2009.

Inflation

Upward pricing pressures are starting to be seen that will lead to increased inflation in the near term (12 – 18 months). Consequently, longer-term rates have increased approximately 50 basis points over the past six months. In the big picture, the excessive debt that has been created globally to provide support during the pandemic is deflationary. The increase in long-term rates that we are starting to see is not likely to be the prelude to substantive increases down the road. Debt service is currently manageable because long-term rates are low. If long-term rates rise too much, increased debt service costs will slow economic activity and thus limit how high long-term rates can go.

We are likely in store for a long period of accommodative monetary policy, which should be supportive of economic activity as well as financial assets. The magnitude of debt we are incurring to support and reinvigorate the economy, however, will probably have some unanticipated consequences down the road that will require ongoing vigilance.

Finally, although the economic table appears set for a recovery in 2021, it is good to remember that primary risks to the recovery remain until the coronavirus is effectively controlled.

Insights

Research to help you make knowledgeable investment decisions