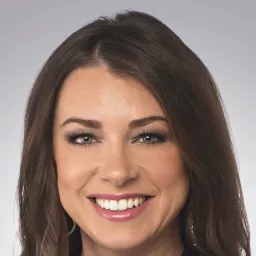

Shannon Hersker joins panel at NRHC 2023 Industry Leaders Conference in Nashville

MINNEAPOLIS (May 3, 2023) — Shannon Hersker, senior vice president – debt/equity, joined a panel at the National Rental Home Council’s (NRHC) Industry Leadership Conference in Nashville, Tenn. The panel discussed homebuilding and the build-to-rent (BTR) market at the recently held conference on April 19.

The panel was moderated by Bruce McNeilage, president – Kinloch Homes. Hersker was joined by three other panelists: Andy Zhu, director of business development – Pentagon Holdings, Cliff Payne, chief investment officer, build-to-rent – Core Spaces, and Bill Roach, vice president, strategy and business development – Northsight Management.

The panel discussion topics included:

- How financing has changed – capital is still available, but with lower leverage and tighter underwriting standards; lenders are being conservative.

- Developers are including a mix of different product types in their communities, such as townhomes with detached homes.

- The differences in amenities and other building materials in different geographical locations, yards with fences are more prominent in the southeast, horizontal multifamily projects are very similar to class A apartments with pools and clubhouses.

During the event, Hersker noted how job growth and corporate in-migration continues in the Nashville market and the majority of renters are choosing single family homes as their preferred housing type.

“One key takeaway from the CEO panel was that SFR and BTR are still a relatively new asset class for many people,” said Hersker. “Property management is key. It is very tedious as it relates to this business and having the right management group is imperative.” The panelists also discussed advice to new groups entering the space: ask for help, mentorship is important to learn from others’ mistakes, and collaboration is key.

Other topics investigated at the conference:

- What is the worst mistake you can make in BTR?

- Why are developers looking to life companies?

- Why does the industry take time to figure out?

- Why are LP groups wanting to do preferred equity or deals on their own?

- Why is labor shortage still an issue?

- Why do renters who can afford to buy a home choose to rent?

Northmarq is a full-service capital markets resource for commercial real estate investors, offering seamless collaboration with top experts in debt, equity, investment sales, loan servicing, and fund management. The company combines industry-leading capabilities with a flexible structure, enabling its national team of experienced professionals to create innovative solutions for clients. Northmarq's solid foundation and entrepreneurial approach have built an annual transaction volume of more than $39 billion and a loan servicing portfolio of more than $76 billion. Through the 2022 acquisition of Stan Johnson Company and Four Pillars Capital Markets, Northmarq established itself as a provider of opportunities across all major asset classes. For more information, visit: www.northmarq.com.