Hurricane Harvey update and the effect on Houston economy

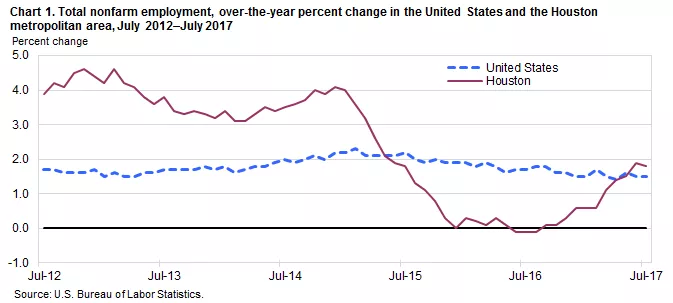

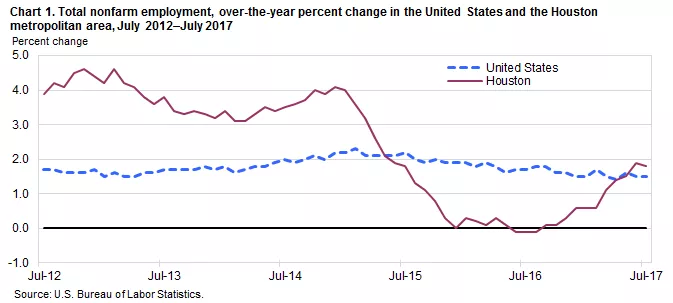

On August 25 Hurricane Harvey struck the Texas Gulf Coast and dropped over 50 inches of rain in certain areas surrounding Houston; creating a massive flooding disaster never seen before. How will this impact the Houston Economy and Real Estate market? Before the Storm, the overall Houston Economy began recovering and the local economy has shown tremendous resiliency & diversity, as the market returns to one of the Nation's leading job creators once again. Houston experienced an increase in employment of 54,200 over the previous 12 months and recent population growth is estimated at over 150,000 people in 2016 according to The Bureau of Labor Statistics reported in July of 2017 and recent Census reports.

First, it is important to note that the majority of the city overall fared well during and after the storm. The media has focused on the worst of the damage, however Downtown was back up and running in 24 hours, the Med Center had very little water damage, and most areas dried quickly after the storm passed. The Bad news: Certain areas, along bayous, which were prone to flood, did flood. The Good news: After the disaster passed 99.5 percent of people are able to remain in their homes, 94 percent of homes suffered no damage, at any given point, more than 98 percent of Houstonians have electric power, and 92 percent of Houstonians never lose power according to local construction firm Linbeck & Government Reports. Average, everyday citizens step up in a big way to take care of family, friends, and neighbors. Many areas of the city were sparred the worst of the flooding. The above-mentioned deluge of water was not reported in most of the city, the two airports received 20-22" of rain during the entire storm and many areas received much less.Click for flood assessment map.

The common reaction is to compare this to other similar natural disasters, Hurricane Katrina as an example, however most experts doubt that Houston will experience anything close to the post-hurricane symptoms suffered by New Orleans. "Houston is not New Orleans. It's a large, diverse, fast growing economy," said Mark Zandi, chief economist with Moody's Analytics. While the city's unemployment rate is now above the national average following the downturn in oil prices, it has been improving, falling to 5.3 percent recently. This event will reinforce many of the job growth trends in Houston, mostly among the blue-collar workforce as major infrastructure projects were delayed or damaged by the storm and will be in need of completion or repair. Additionally construction, renovation, and rebuilding projects large & small across the city will begin.

Property Damage Assessment:

Initial analysis by Costar & Yardi Matrix has found that the damage to office and multifamily properties was less than what could have transpired given the record rainfall. Further, Harvey's aftereffects will provide a boost to fundamentals in the short term, as demand for living space from residents (mostly homeowners) displaced by the storm will boost multifamily occupancies. Houston's multifamily universe consists of 616,000 units, roughly 157,000 of which are in areas identified as flood zones. Damage to units in flood zones was much higher than in non-flood zones. Initial Estimates are that between 45,000 and 72,000 units-or 7-11 percent of the multifamily universe-were rendered potentially uninhabitable. Therefore, the occupancy rate is expected to rise sharply and rent growth to turn moderately positive in the near term.

Harvey damaged or destroyed some 127,600 single-family homes in the Houston area, according to the most recent data from the Texas Division of Emergency Management. We expect that many displaced households will move into apartments in the short term, which will fill up most of the approximately 45,000 vacant units in the metro. Demand will likely be highest among Class-A units, which will be sought after by homeowners that want a comparable quality of life. Lower income apartment properties in the Class-B/C space are also likely to be mostly filled by displaced residents or construction and remediation workers. Our expectation is that Houston rent growth will turn moderately positive in upcoming months. The boost to fundamentals should be strong up front and begin to tail off within a year, but there should be an ongoing benefit over the long term from the combination of higher demand, less overall stock and reduced deliveries, as construction is focused on critical infrastructure and repair of existing units.

Some multifamily experts say there may not be enough apartment supply to meet the sudden increase in demand. Bruce McClenny, MetroStudy, told HBJ that he expects the demand to be significant for the next 6-12 months, however this will decrease as people fix their homes and leave temporary apartment lodging. Apartment managers will also begin repairing units and have more supply available to lease, which could take up to a year to remediate & renovate. "The positive impacts have been immediate, however there be more supply (slowly come on line), which is one of those dynamics that's opposite of what just happened," he said.

The flood had a relatively mild impact on most commercial property types. A few dozen office buildings suffered some damage, but that was a relatively small proportion of a segment with more than 220 million square feet. What's more, reports are that the entire downtown office market was fully functioning in less than a week. Moody's estimates that 6-8% of industrial land was damaged. A much bigger impact was felt in the energy sector. The Gulf Coast is home to the nation's largest oil refineries. An estimated 30 percent of U.S. refining capacity was shut down, and much of that could remain offline for weeks. The result will be a drawdown in reserves and a 10-20 percent increase in gasoline prices nationally for the next few months.Outcomes:

There is no doubt that the Texas Gulf Coast withstood a historical Hurricane event which led to devastation in Port Aransas & Rockport, and massive flooding in Houston, Beaumont, & Port Arthur. This will take years to rebuild, which means FEMA & insurance companies will inject many billions of dollars into the recovery. Other economic stimuli will come from replacement of the more than 500,000 vehicles that were damaged and as much as $10 billion of infrastructure that must be repaired.

"The catastrophe from Harvey will produce a ripple throughout the Houston economy. I would expect occupancy to rise among self-storage, apartment, and hotel properties. Pre-Harvey, all three of these property types were overbuilt, so this will help current owners, assuming the property is not damaged or destroyed. Property repairs will be a boon for job growth, along with new residential construction. This wave will be temporary as the property types attempt to regain equilibrium, but it could last for several years."Specific Comments from MetroStudy

Image

About Northmarq

Northmarq is one of the largest privately held commercial real estate firms in the United States, combining a nationwide presence with deep local expertise. With more than 50 offices across the country, we provide a full suite of debt, equity, investment sales, loan servicing and fund management solutions for a comprehensive range of property types. Our unique structure allows us to connect clients with the best opportunities, yet be nimble enough to ensure access to every expert across our company. The firm manages a loan servicing portfolio of over $78 billion and has completed $69.5 billion in transactions over the past three years. At Northmarq, collaboration fuels results, helping clients achieve success in every market, nationwide. For more information, visit www.northmarq.com.