Mortgage Rate Update

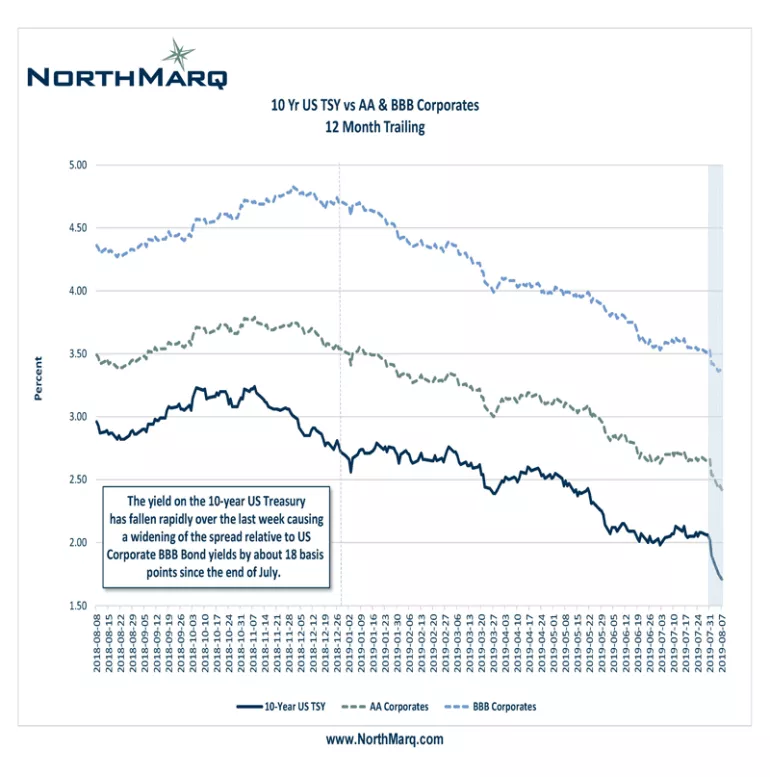

The yield on the 10-Year U.S. Treasury dropped significantly over recent weeks with a decline of about 35 basis points since the end of July. A lower index is good for borrowers, but what about the spread? Many lenders price their mortgage spreads relative to what they can get in alternative investments such as U.S. Corporate Bonds. Corporate bond yields have continued to move in the same direction as Treasuries, which is good news for Borrowers. However, the spread between the 10-Year U.S. Treasury and average BBB corporate bond yields has increased by about 18 basis points since the end of July.

This is part of the reason why some lenders have increased their spreads in a falling rate environment. Between falling treasury yields and widening spreads, borrowers are still seeing a net benefit from commercial mortgage rates which are lower by about 15-20 basis points since the end of July. Still a great time to lock in long term!

Insights

Research to help you make knowledgeable investment decisions