Inland Empire Q4 Multifamily Market Report: Large Transactions Return in Final Quarter of 2020

Highlights:

- The Inland Empire was impacted by the pandemic considerably less than the rest of California, and the local multifamily market outperformed in 2020. While the market recorded significant layoffs, major logistics companies like Amazon continue to expand, providing some support to the employment market.

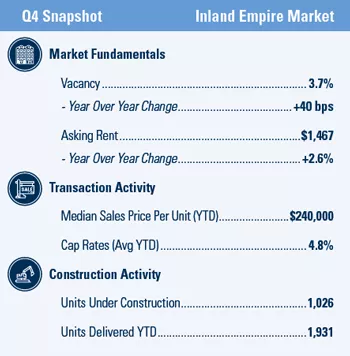

- Vacancy rose 40 basis points in 2020, reaching 3.7 percent, but all of the increase occurred in the first half of the year. During the second half, the rate dipped 10 basis points.

- Apartment rents in the Inland Empire increased 2.6 percent during 2020, reaching $1,467 per month. Rents contracted in nearly all California markets during the year, but the Inland Empire’s healthy absorption totals supported steady rent increases.

- The multifamily investment market gained momentum in the fourth quarter. The median price rose 9 percent in 2020 to $240,000 per unit, while cap rates averaged 4.8 percent. Late in the year, activity picked up in larger transactions; during the final few months of the year, nearly 65 percent of deals traded for more than $50 million.

Related Articles

Insights

Research to help you make knowledgeable investment decisions