August Economic Commentary: Fed continuing to tighten despite slowing economy

Chief Economist

Pohlad Companies

Economic data reported during the past month show an economy that is decelerating, but with inflationary pressures that remain elevated. The Federal Reserve is committed to doing whatever is necessary to achieve price stability and is, consequently, in a position of tightening monetary policy in an economy that is already weakening. As a result, the pathway for the Fed to achieve their desired soft landing for the economy is becoming increasingly narrow.

Consumer Price Index, Commodity Prices, Retail Sales

The stronger-than-expected reading of the Consumer Price Index (CPI) for June (released in mid-July) showed headline inflation growing 9.1% year over year – up from the 8.6% reading for May – and resulted in the Fed making another 75-basis-point (bp) increase in the Fed Funds rate at their meeting on July 27, bringing the Fed Funds rate to 2.50%.

It should be noted that over the past few months, commodity prices have fallen sharply, which will contribute to weaker price pressures ahead. However, wage pressures are stickier and remain elevated – especially with the robust employment report discussed below — thus at least partially mitigating the impact of lower commodity prices.

Following up on the strong CPI report, retail sales for June were reported to have increased a healthy 1.0%, but the increase was mainly due to increasing prices. Inflation-adjusted retail sales were essentially flat – a sign of softening demand. With inflation-adjusted disposable incomes declining 3.2% year over year, incomes are not keeping up with inflation, resulting in weakening consumer demand.

Leading Economic Indicators

A report that doesn’t garner a lot of press is the reading of Leading Economic Indicators (LEI). LEI is a compilation of 10 economic measures by the Conference Board that historically lead the direction of the economy. For example, jobless claims, consumer goods orders, and building permits are three of the 10 components. The reading of the LEI for June fell for the fourth consecutive month to a 10-month low. Historically, such a string of declining readings has only happened when the economy is in or nearing a recession.

Q2 GDP

The initial reading of Q2 GDP was reported at a negative 0.9% annualized rate. The consensus was expecting a positive reading. Following up on the -1.6% reading for Q1 GDP, declarations that the economy is already in recession have become more abundant. Successive quarterly declines in real economic activity are not part of the official NBER determination of a recession — but successive quarterly declines have only occurred during periods of recession since 1947.

Employment

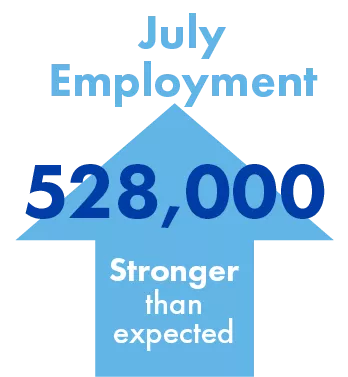

Concerns about the economy being in recession were put on hold, however, by the July employment report released last Friday. The unexpected acceleration in non-farm payroll growth in July (+528,000), together with the further decline in the unemployment rate (3.5% — the lowest since 1969) and the renewed pick-up in wage pressures, suggests the economy is not in a recession. Employment is now back to the pre-pandemic level.

Fed Impacts

All of this leaves the Fed in a challenging position. Although most of the recent economic reports indicate a slowing economy, the strength of the employment report doesn’t confirm existing economic weakness. It should be remembered, however, that employment is a coincident, not leading, economic indicator, and always peaks just as the downturn begins and has never provided an early warning of an impending recession.

The next Fed meeting is September 21, and there will be one more employment report and two CPI reports before that, so there is plenty of room for expectations to change. The Fed continues to reiterate its commitment to price stability as the bedrock of long-term economic growth. Consequently, it will take quite a bit of improvement in inflationary pressures for the Fed to alter their tightening stance. Fed officials have recently been quoted as saying that work on inflation is “nowhere near almost done.”

As of now, markets are pricing in a 50-bp hike in Fed Funds in September and one to two hikes of 25 bp at the remaining two meetings this year, which would bring the Fed Funds rate to 3.50% at year end. Markets are also pricing in the expectation that the Fed will start cutting rates in the second half of 2023.

Understanding that Fed actions take 12-18 months to fully work their way through the economy, slower economic growth should be expected at least into early second-quarter 2023. Whether or not a recession is officially declared is a matter of semantics. The implementation of Fed policy holds the key to future economic activity, and based on what we know today, the probability of continued slow to negative economic growth is high.

Insights

Research to help you make knowledgeable investment decisions