NorthMarq’s Denver office arranges acquisition financing of $18.7 million for Lodo’s Bar & Grill Portfolio in Colorado

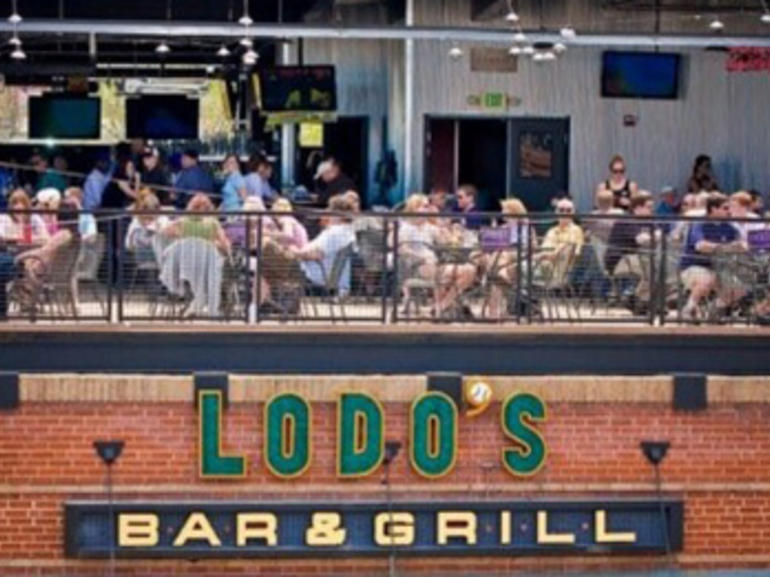

DENVER, COLORADO (January 14, 2019) – Jeff DeHarty, vice president of NorthMarq’s Denver regional office, arranged acquisition financing of $18.7 million for the Lodo’s Bar & Grill portfolio on behalf of the Monfort Companies and Summit Capital Venture Group. The portfolio acquisition includes locations in downtown Denver, Highlands Ranch and Westminster, consisting of 4.4 acres of real estate and all existing business operations.

The non-recourse, floating rate debt was originated through a relationship with a national bridge lender. The high leverage debt facility allowed for acquisition, future capital improvements, and interest carry. “NorthMarq was pleased to be involved in securing acquisition financing which met sponsorship objectives, and allowed for flexible executional strategies,” said DeHarty.

The principals of this joint venture including Kenneth Monfort, Jason Marcotte, and Matt Runyon intend to be stewards of the historical downtown site, which is located a block from Coors Field in the lower downtown neighborhood. “Historic locations like the original Lodo’s captures the authentic spirit of Denver. Our larger vision for a unified Denver Stadium District requires iconic locations such as this to be preserved and enhanced so they can continue to draw people to this vital neighborhood for generations to come,” said Monfort. “We are appreciative of NorthMarq’s efforts in aligning us with a capital partner who understands our unique vision and long term goals,” said Runyon.

Northmarq is a full-service capital markets resource for commercial real estate investors, offering seamless collaboration with top experts in debt, equity, investment sales, loan servicing, and fund management. The company combines industry-leading capabilities with a flexible structure, enabling its national team of experienced professionals to create innovative solutions for clients. Northmarq's solid foundation and entrepreneurial approach have built an annual transaction volume of more than $39 billion and a loan servicing portfolio of more than $76 billion. Through the 2022 acquisition of Stan Johnson Company and Four Pillars Capital Markets, Northmarq established itself as a provider of opportunities across all major asset classes. For more information, visit: www.northmarq.com.