February Economic Commentary: Fed Shifts Focus as Inflation Accelerates

Chief Economist Pohlad Companies

Turning the page on 2021, the economic reports issued during January painted a picture of a slowing economy due to expiring fiscal stimulus, rising inflation, and uncertainties related to the Omicron variant. With inflation accelerating faster than the growth in consumer incomes, the Fed left no doubt at their late January meeting that achieving price stability will be the focus of monetary policy for the foreseeable future.

Inflation

Inflation is foremost in the minds of business executives, consumers, investors, and of course the Fed. The December reading of the Consumer Price Index (CPI) hit another 40-year high at 7.0%. Although we are probably within a month or two of the peak in CPI readings, inflation pressures are likely to stay above the Fed’s desired 2% target for the remainder of the year as increasing rent growth and other persistent cyclical pricing pressures are incorporated into the calculation of the CPI during the year.

Wages are increasing at 5.7% year over year, but that’s not enough to keep up with the current inflation. Real disposable personal income – the money that consumers have left over after paying taxes and adjusted for inflation – declined again in December. Not surprisingly, personal consumption expenditures adjusted for inflation were negative in November and December. Consumers are slowing their spending patterns.

GDP

The initial reading of GDP for the fourth quarter showed an acceleration to 6.9% annualized from 2.3% annualized in the third quarter. The details of the report belie the apparent strength, however. GDP was bolstered by a record surge in inventories that accounted for 70% of the increase. Inventory growth was high as businesses rebuilt their stocks at a faster rate than consumers were purchasing goods. Consumer spending, typically the driver of economic growth, accounted for only a third of the GDP growth. Inventory growth will likely reverse in the first quarter of 2022 and end up being a drag on GDP.

Employment

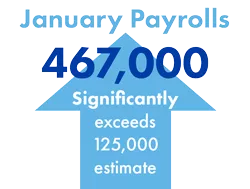

The recently released employment report for January provided the biggest surprise. January payrolls increased by 467,000, far more than the estimate of 125,000. Additionally, there were significant upward revisions to the gains in the prior two months. Prior to the report, there were concerns that the impact of Omicron might produce a negative reading for the month. To have a strong report during the peak of Omicron cases suggests that the labor market is even tighter than previously thought. The one metric that was affected by Omicron was the aggregate hours worked during the month. They fell by 0.3% as worker absences were increased. The unemployment rate ticked up to 4.0% due primarily to some updates to population estimates. The tight labor market is supporting continued wage increases, currently at 5.7% year over year.

Fed Focus

All of this has caused the Fed to focus on their mandate for price stability. The strength of the January employment report virtually ensures that the Fed will raise rates at their next meeting in mid-March. The overall language from the Fed has turned decisively hawkish and markets are now pricing in five rate hikes in 2022. Whether this actually occurs will be dependent on the path of inflation and the reaction of the economy to a less accommodative monetary policy. In addition to rate hikes, the Fed is developing a plan to reduce the size of their balance sheet by allowing maturing bonds to run off but could evolve into selling some longer dated bonds to push up long yields. In short, the tailwinds of accommodative fiscal and monetary policies have reversed and are now headwinds. Economic growth was always expected to slow in 2022, but the speed with which these policies have reversed will likely cause the slowing to occur more quickly than previously expected. The Fed’s goal is to bring inflation pressures down while slowing the economy without causing a recession – in other words, create a soft landing. The Fed has accomplished soft landings before, but the economy’s dependence on low interest rates and accommodative Fed policies today makes this time particularly challenging.

Insights

Research to help you make knowledgeable investment decisions