Debt & Equity Financing

Your goals. Your success. Financed by Northmarq.

Commercial real estate (CRE) offers unrivaled opportunity for income and capital appreciation. That’s been true historically, and despite challenges, it’s still true today. Your success in CRE depends on access to the capital markets, in all their varied and complex forms.

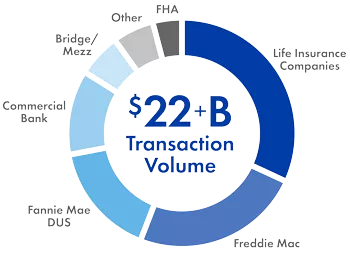

No privately owned CRE finance provider is larger than Northmarq. None can boast of a more comprehensive network of private and commercial financing sources. We have strong, well-established partnerships with institutional lenders including national and regional banks, insurance companies, and government agencies such as Freddie Mac, Fannie Mae, and FHA/HUD. We also work with Wall Street investment banks, private equity firms, and hedge funds to access private, specialized, or creative funding for our clients.

When considering a commercial real estate investment, you can’t know in advance what the financing will look like, but you can be confident that Northmarq has the expertise and the capacity to provide you with the right funding for your unique needs.

Ready to get started? Contact a financing expert today.

Commercial Property Financing — Debt

Commercial mortgage lending is a foundational element of CRE finance. It’s the biggest part of our business. If you invest in CRE — or are planning to — you’re likely going to require debt financing. You’re going to need options, and a trusted advisor is essential. You’re going to need Northmarq on your side.

Let’s take a look at some of the debt capital solutions we offer.

Non-Recourse Commercial Mortgages

A non-recourse loan is a commercial mortgage that’s wholly secured by the equity in the collateral property. A personal guarantee from the borrower is not required. This makes non-recourse lending one of the most attractive forms of commercial real estate financing.

Permanent Fixed Rate Loans

Fixed rate loans feature a fixed interest rate for the life of the loan. The benefit is twofold: it offers protection against interest rate risk and provides financial stability by supplying debt service predictability.

Permanent Floating Rate Loans

Floating rate loans have interest rates that fluctuate based on a predetermined adjustment schedule. Because mortgage payments can change based on the rate environment, floating rate products are best suited for short-term financing needs, such as construction loans.

Multifamily Construction Loans

The need for new apartments, including new or renovated affordable housing units, is well documented. Multifamily construction financing is generally provided by government agencies or specialized lenders. Rules must be followed to the letter, and a trustworthy mortgage broker is a must.

Tax-Exempt Financing

The federal government offers valuable tax credits to developers and investors who invest in certain government-sponsored CRE that can include industrial and retail properties. When used judiciously, tax credits can greatly offset the cost of borrowing and, in essence, be a form of tax-exempt financing.

Bridge Loans

Bridge lending is intended to “bridge” the significant time gap that can exist between immediate borrowing needs and the closing of conventional financing. Bridge loans can be fixed or floating rate, but in either case, speed of execution is critical.

Mezzanine Debt

Mezzanine financing is a sophisticated type of lending structured to be subordinate to senior debt, such as a first mortgage, yet technically isn't a second mortgage. In the event of default, mezzanine borrowers won’t be repaid until senior borrowers are satisfied.

Credit Tenant Lease (CTL) Transactions

CTL finance is a unique lending platform used for the purchase or construction of net lease CRE. CTL loans are secured by the rental income a lease produces rather than by equity in the property.

Forward Commitments

Forward commitments are binding commitments by a lender to provide a CRE loan at a specified time in the future. They are particularly helpful when construction or other financing is distinct from permanent financing.

Green/Sustainable Financing

Eco-friendly buildings aren’t just good for our environment; thanks to energy cost savings, they’re good for the bottom line as well. Northmarq is eager to fund sustainable buildings whether they're office, medical, or other CRE properties - with fixed or floating rate commercial mortgage loans.

Commercial Property Financing — Equity

When debt financing is not appropriate or, due to time or documentation constraints, not possible, equity financing becomes necessary. Our funding network includes private equity firms, venture capitalists, hedge funds, and high net-worth investors willing and able to make an investment in you and your CRE project.

Here's a look at some of our equity platforms.

New Construction Equity

Banking institutions can be hesitant to lend against CRE until it begins producing income. Equity financing is often the right finance solution for land, construction, and development projects.

Acquisition Joint Ventures

We at Northmarq can act as central agents between investors with money to put to work and clients who need financing. If you need a capital partner for an acquisition, we can find the right investor and structure a mutually beneficial joint venture.

Presales Equity

“Presales” — selling CRE units before they’re completed — are invaluable to developers. They generate revenue and demonstrate the viability of a project. We make preselling easier by using equity financing to allow developers to offer presale purchase financing to buyers.

Company-Level Equity Investments

In addition to the capital needed to build or buy CRE, it takes money to run a real estate business. We know of many private equity firms, venture funds, and wealthy individuals who are prepared to immediately invest in a well-run, profitable CRE firm – maybe yours.

Contact Us to Learn More

Northmarq is an established leader in commercial real estate finance, but it's your success that's at the forefront of our mind as we continue to grow. Whether you’re a large, established developer or a first-time commercial real estate investor, we’re committed to providing you with the financing you need to achieve your commercial real estate objectives. Contact your nearest Northmarq office to leverage our resources and facilitate your success.