Denver Q2 Multifamily Market Report: Investment Activity Spikes as Fundamentals Post Unprecedented Gains

Highlights:

- Strong renter demand for apartments in the Denver multifamily market drove down vacancy rates and fueled an accelerating pace of rent growth in the second quarter. Improving operations carried over to the investment market, where transaction activity gained momentum, prices rose, and cap rates compressed.

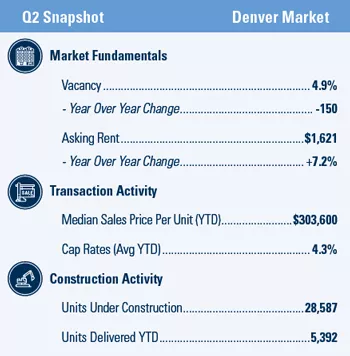

- Vacancy tightened considerably during the second quarter, falling 110 basis points to 4.9 percent. The rate has improved by 150 basis points year over year.

- Net absorption totaled nearly 5,000 units in the second quarter. In the past year, absorption has topped 12,000 units, a record for a 12-month period.

- After holding steady in recent periods, the pace of rent growth has spiked in recent months. Rents ended the second quarter at

$1,621 per month, 7.2 percent higher than one year ago. - Investment activity surged during the second quarter, with sales of newer, Class A properties leading the way. The median price thus far in 2021 is up more than 20 percent to approximately $303,600 per unit, while cap rates have compressed to 4.3 percent.

Related Articles

Insights

Research to help you make knowledgeable investment decisions