Dallas-Fort Worth Q1 Multifamily Market Report: Investment Activity Starts 2021 on an Upswing

Highlights:

- The Dallas-Fort Worth multifamily market posted continued growth to start 2021. Developers continued to bring new projects through the construction pipeline, while absorption gained momentum. With demand elevated, rents rose and the investment market remained competitive.

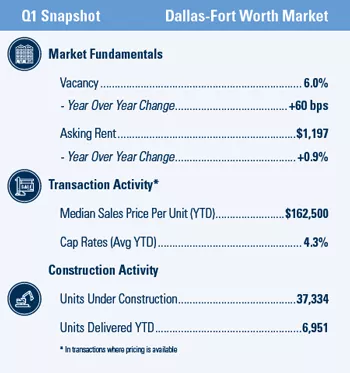

- The combined vacancy rate across Dallas-Fort Worth ended the first quarter at 6 percent, up 60 basis points from one year ago. Vacancy is forecast to tighten in the coming quarters.

- Net absorption totaled more than 3,500 units during the first quarter, ahead of the pace that has been established in recent years. In the first quarters of 2019 and 2020, absorption averaged approximately 2,800 units.

- After rents were flat for most of 2020 as owners focused on tenant retention, rents rose 1.2 percent during the first quarter. Average asking rents ended the first quarter at $1,197 per month.

- The local investment market remained active during the first quarter, with prices rising and cap rates compressing. In transactions where sales information is available, the median per-unit price rose 12 percent from 2020 levels, while cap rates dipped to approximately 4.3 percent.

Related Articles

Insights

Research to help you make knowledgeable investment decisions