Corporate bond market’s potential impact on commercial real estate lending

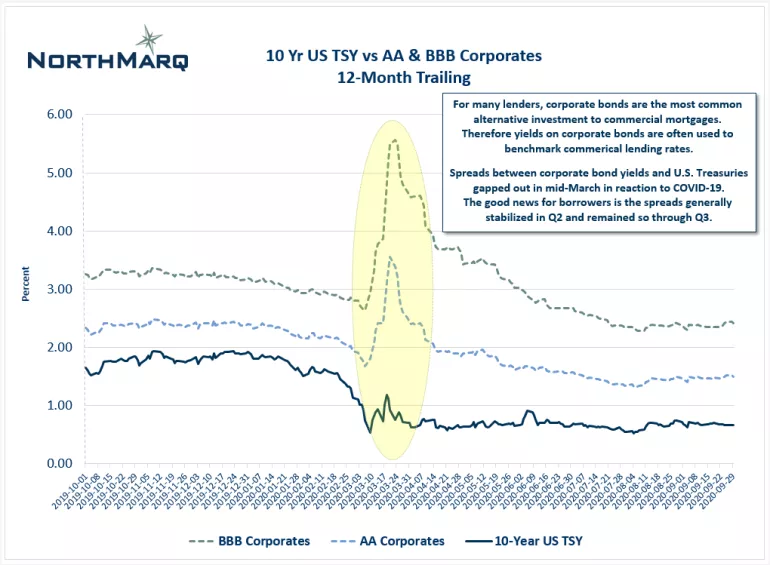

The 10-year U.S. Treasury holds great importance as a key benchmark for mortgage rates in the United States, but this only part of the story. The chart below shows the yield for the 10‐year U.S. Treasury over the past 12 months along with the average yields on AA corporate bonds and BBB corporate bonds.

Why is this of interest? For many lenders, corporate bonds are the most common alternative investment to commercial mortgages. What happens in the corporate bond market can influence lender behavior and what rates they will offer on commercial loans.

As the COVID-19 pandemic shut down economies around the globe, there was a natural flight to quality and de-risking in the capital markets. Instability in the oil markets exacerbated investor concerns. On March 8, the yield on the 10-year U.S. Treasury touched an all-time low of 0.318 percent during overnight trading; however, corresponding volatility in the corporate bond market forced many lenders to the sidelines. Ultimately the Fed stepped in and began aggressively buying securities. This, along with other stimulus packages both in the U.S. and globally, resulted in a steady drop in corporate bond yields, which leads us to where we are today. As the chart shows, there has been relative stability between the yields on the 10-year U.S. Treasury and corporate bonds through the second and third quarters. This allowed lenders to return to the market and for many borrowers to once again take advantage of commercial mortgage rates at or near historic lows.

As we enter the fourth quarter and look ahead into 2021, we expect the yield on the 10-year U.S. Treasury will remain relatively low. The real risk for borrowers is a return to volatility in the corporate bond market. We will continue to keep an eye on potential market disruptors such as a resurgence in COVID-19, election turmoil, or international disputes. Corporate bond yields could also be pushed higher by large volumes of new issuances as firms try to raise liquidity and take advantage of a low cost of capital.

Borrowers may want to consider acting sooner rather than later to lock in favorable rates before a return to volatility in the corporate bond market. NorthMarq represents more than 50 institutional lenders along with Freddie Mac, Fannie Mae, and FHA, as well as maintaining relationships with local, regional and national banks. If you have an upcoming loan maturity or a step down in your prepayment penalty, NorthMarq can help you lock rate early and target your preferred closing date as far out as six months. Reach out to a NorthMarq loan officer to learn how we can help you manage your interest rate risk both prior to closing and for the life of the loan.

Northmarq is a full-service capital markets resource for commercial real estate investors, offering seamless collaboration with top experts in debt, equity, investment sales, loan servicing, and fund management. The company combines industry-leading capabilities with a flexible structure, enabling its national team of experienced professionals to create innovative solutions for clients. Northmarq's solid foundation and entrepreneurial approach have built an annual transaction volume of more than $39 billion and a loan servicing portfolio of more than $76 billion. Through the 2022 acquisition of Stan Johnson Company and Four Pillars Capital Markets, Northmarq established itself as a provider of opportunities across all major asset classes. For more information, visit: www.northmarq.com.