Corporate History

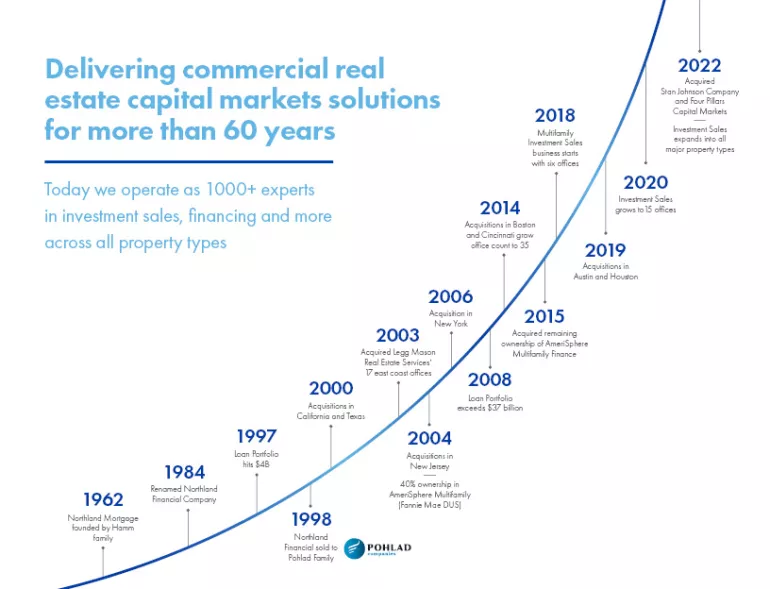

Northmarq began in the 1960s as a financing business within a holding company of mortgage banking, real estate and insurance companies owned by the Hamm Family. From our first office in St. Paul, Minnesota, the company has expanded into a firm with offices across the country and evolved from a strictly residential mortgage banker to a full-service company skilled in capital solutions, multifamily investment sales, and servicing for all commercial property types.

In 1999, the company was acquired by the Pohlad family when the Hamm family sold its operating companies. By early 2000, Northmarq began a run of 13 acquisitions that added 25 offices and 200 employees to the company. The largest of those acquisitions was Legg Mason Real Estate Services, which included 17 offices on the East Coast and a $10 billion servicing portfolio.

To diversify the company’s platform, Northmarq acquired a 40% stake in AmeriSphere Multifamily Finance L.L.C., an Omaha-based Fannie Mae DUS lender, in 2004. In 2015, Northmarq acquired the remaining interest in AmeriSphere and began operating it as a wholly owned subsidiary called NorthMarq Capital Finance.

Other acquisitions include:

- Dallas-based Askew/Reese Investment Co. and San Francisco-based Trowbridge, Kieselhorst & Co., both in 2000;

- James R. Poole & Co. in New Jersey in 2004;

- First Monroe of Rochester, NY, in 2006;

- Baird & Warner Real Estate Finance in Chicago in 2007;

- Crouse & Associates in Raleigh, NC, in 2008;

- New England Realty Resources in Boston in 2012;

- Quest Commercial Capital Corporation in Cincinnati in 2014;

- Western Capital Realty Advisors in Salt Lake City and Daisley Ruff Financial Corporation in Omaha in 2017;

- Texas Realty Capital in Austin, TX, and Kinghorn, Driver, Hough & Co. (KDH) in Houston, TX, in 2019; and

- Stan Johnson Company and Four Pillars Capital Markets in 2022.

The company’s expansion has also included opening new offices in cities across the country to provide a national platform for talented industry experts. We started our multifamily investment sales business line with operations in Phoenix, Dallas, and Kansas City in 2018. In 2019, the platform extended to Newport Beach, San Diego, and Atlanta. In 2020, we added experts in Fort Lauderdale, Tampa, Austin, San Antonio, Denver, and Los Angeles with plans to continue expanding this service into every market where we offer debt, equity, and loan servicing.

Today Northmarq is one of the largest commercial real estate capital markets firms in the U.S. with more than 40 offices and more than 1,000 employees who carry on our legacy of providing the highest-quality service to real estate investors, developers, and lenders for more than 60 years.