NorthMarq Capital’s Rochester office arranges $73 million refinance for Arizona-based resort and spa

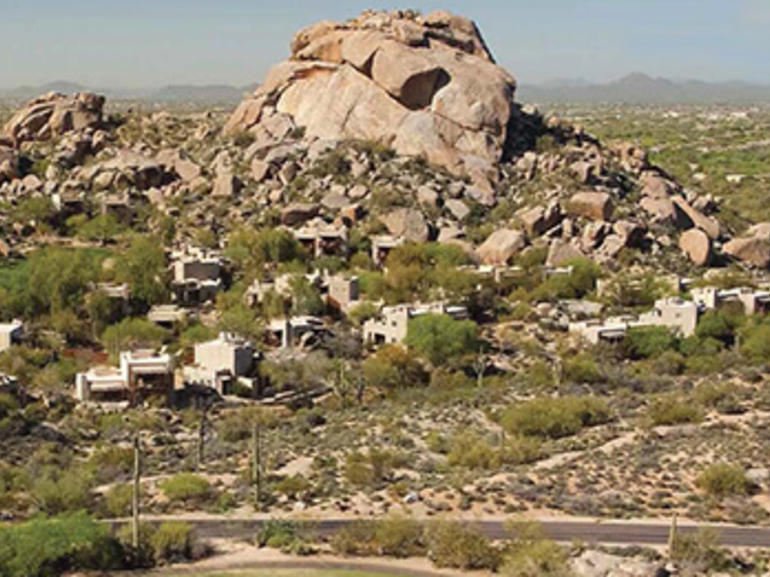

ROCHESTER (September 26, 2018) – Derek Carroll, senior vice president/senior director of NorthMarq Capital’s Rochester regional office, secured the $73 million refinance of an award winning resort and spa located near Scottsdale, Arizona. NorthMarq arranged financing for the borrower through its relationship with an international bank. The permanent-fixed loan was structured with a 5-year term on a 30-year amortization schedule.

Spa amenities on the property include: heated swimming pool, a labyrinth designed for meditation, detoxifying steam and spa rooms, a fitness center Hotel amenities include: home-style villas and luxury haciendas, 50,000 sq. ft. of meeting/event space, on-site recreational and adventure activities, two Jay Morrish-designed championship golf courses and a golf academy, four swimming pools, several restaurants, lounges and cafés, a private heli-pad and eco-friendly operating standards.

“In addition to a number of highly competitive fixed rate options, we were able to offer multiple mezzanine finance options. Ultimately, they were not needed due to the competitiveness of the senior lender,” said Carroll

Northmarq is a full-service capital markets resource for commercial real estate investors, offering seamless collaboration with top experts in debt, equity, investment sales, loan servicing, and fund management. The company combines industry-leading capabilities with a flexible structure, enabling its national team of experienced professionals to create innovative solutions for clients. Northmarq's solid foundation and entrepreneurial approach have built an annual transaction volume of more than $39 billion and a loan servicing portfolio of more than $76 billion. Through the 2022 acquisition of Stan Johnson Company and Four Pillars Capital Markets, Northmarq established itself as a provider of opportunities across all major asset classes. For more information, visit: www.northmarq.com.