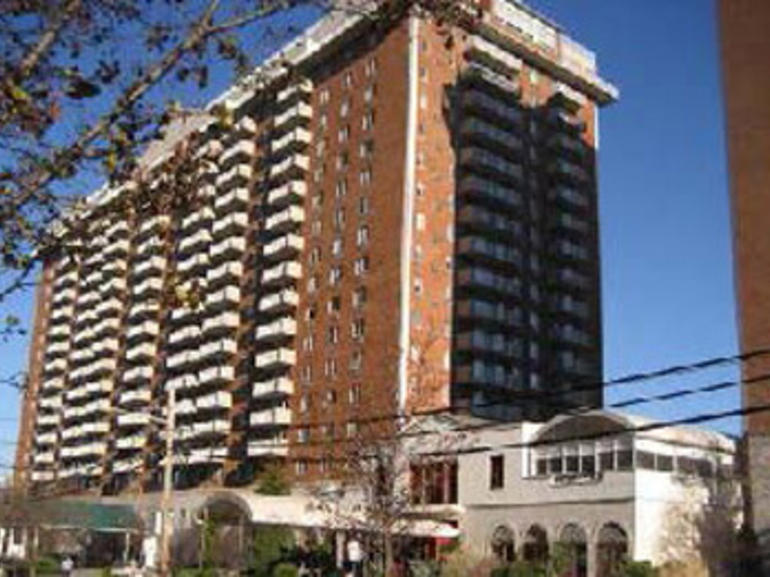

NEW JERSEY (July 20, 2015) – Robert W. Ranieri, senior vice president/managing director of NorthMarq Capital’s Greater Westchester NY/CT based regional office and Greg Nalbandian, senior vice president/managing director of NorthMarq’s New Jersey based regional office collaborated to arrange the $51.844 million refinance of Excelsior II, a 267 unit multifamily property with 11 professional spaces located at 170 Prospect Avenue in Hackensack, New Jersey. The transaction was structured with a 10-year term and 30-year amortization schedule. NorthMarq arranged financing for the borrower through its seller-servicer relationship with Freddie Mac. “The loan represented a refinance of an existing Freddie Mac mortgage for a long-time Freddie Mac borrower,” explained Ranieri. “The property is one of the premiere multifamily complexes in Hackensack.” Nalbandian added that “this early refinance was a win-win for the sponsor as he was able to significantly reduce his interest rate while cashing out significant equity.”

Northmarq is a full-service capital markets resource for commercial real estate investors, offering seamless collaboration with top experts in debt, equity, investment sales, loan servicing, and fund management. The company combines industry-leading capabilities with a flexible structure, enabling its national team of experienced professionals to create innovative solutions for clients. Northmarq's solid foundation and entrepreneurial approach have built an annual transaction volume of more than $39 billion and a loan servicing portfolio of more than $76 billion. Through the 2022 acquisition of Stan Johnson Company and Four Pillars Capital Markets, Northmarq established itself as a provider of opportunities across all major asset classes. For more information, visit: www.northmarq.com.