Phoenix Q4 Market Report: Investment Volume Surges to Close 2019

Highlights:

- The Phoenix multifamily market recorded a very strong 2019, with rents posting sizable gains and vacancy creeping lower. Conditions cooled slightly during the fourth quarter, which may be an early indication of a more modest pace of growth in 2020.

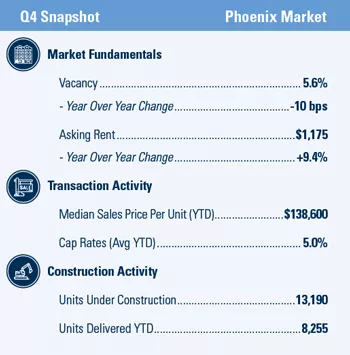

- Vacancy ended 2019 at 5.6 percent, 10 basis points lower than at the end of the preceding year. The rate ticked up 10 basis points from the third quarter to the fourth quarter.

- Asking rents spiked 9.4 percent in 2019, one of the most significant rises in the country. Rents ended the fourth quarter at $1,175 per month.

- Projects totaling more than 8,200 apartment units were delivered in 2019, and the development pipeline includes nearly 13,200 additional units currently under construction. In recent years, demand has been sufficient to absorb the new development while keeping vacancy in a tight range.

- Multifamily investment activity surged in 2019, with momentum growing throughout the year. The median price spiked, reaching $138,600 per unit for the full year and approaching $150,000 per unit in the second half. Cap rates averaged 5 percent in 2019, with lower rates recorded in the closing months of the year.

Related Articles

Insights

Research to help you make knowledgeable investment decisions