October Economic Commentary: Losing Steam as Uncertainty Continues

Chief Economist

Pohlad Companies

As we turn the page from the third quarter to the fourth quarter of 2020, recent data indicate that the initial economic bounce witnessed after the implementation of the historic government programs is clearly losing steam. The future path of the virus remains unknown, further government fiscal support is being held captive by partisan politics, and election rhetoric is corrosive. Let’s start by looking first at the recent employment report released on October 2.

Employment

The September employment report confirmed the trend of slowing employment growth. While positive, the magnitude of improvement peaked in June and has been consistently falling ever since. 661,000 new jobs were added in September, but that is less than half the gain registered in August. Headlines were quick to pick up on the decline in the unemployment rate to 7.9% from 8.4%, but that was mainly due to a significant decline in the labor force participation rate as a result of people no longer actively looking for jobs. You need to be looking for a job to be counted among the unemployed.

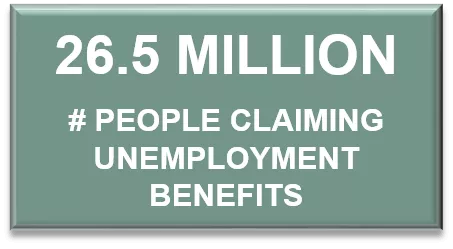

One statistic that is rarely highlighted is the total number of people claiming unemployment insurance benefits. As of the middle of September, 26.5 million people were claiming some form of unemployment benefits. Compare that to the pre-COVID period when the number was routinely around 2.1 million.

These employment numbers are likely to continue to weaken as we move into the fourth quarter. Over the past few weeks there have been major layoff announcements by corporations such as Disney, American Airlines, and several Wall Street banks. The sectors of the economy that were most impacted by the virus, such as airlines, hotels, and restaurants, are unlikely to find any improvement in business conditions as the weather cools and people are more likely to stay home rather than venture into indoor spaces. The U.S. Chamber of Commerce reported that 25% of small businesses have shut down—that number is expected to increase as we head into winter without some form of fiscal support.

As employment growth weakens, personal income slows and the ability of the consumer to spend is negatively impacted. The report on personal income for August showed that incomes fell in August by the most in three months after the government’s special unemployment benefits expired at the end of July. This will likely slow consumer spending as we head into the fourth quarter.

GDP

All of these factors continue to suggest a slow recovery. The final reading for second-quarter Real GDP came in at -31.4% (that’s an annualized number). The first reading for the third-quarter Real GDP will be released on October 29th and is estimated to be +28% (annualized). Despite the expected strong third-quarter reading, Real GDP for the entire year of 2020 is estimated to be about -4.5%. Current forecasts suggest that it will take until the middle of 2022 to regain the level of GDP that we experienced at the end of 2019.

Inflation

A slow recovery suggests that inflationary pressures will remain subdued (despite the Fed’s desire for higher inflation), and consequently, the Federal Reserve is expected to keep the Federal Funds rate between 0% and 0.25% through 2023. Interest rates further out on the yield curve appear to be confirming the slow recovery assumption with the 10-year Treasury bond currently yielding only 0.69%.

Looking forward

In summary, despite the economic progress that has been made since April, the overall loss in economic activity since February remains substantial. Further progress will be dependent on the consumer’s ability and willingness to spend, which is directly correlated to the successful containment of the virus. Until effective therapeutics or a vaccine are developed, additional government programs to assist businesses and individuals are likely needed to avoid the economy stalling during the upcoming winter months.

Northmarq is a full-service capital markets resource for commercial real estate investors, offering seamless collaboration with top experts in debt, equity, investment sales, loan servicing, and fund management. The company combines industry-leading capabilities with a flexible structure, enabling its national team of experienced professionals to create innovative solutions for clients. Northmarq's solid foundation and entrepreneurial approach have built an annual transaction volume of more than $39 billion and a loan servicing portfolio of more than $76 billion. Through the 2022 acquisition of Stan Johnson Company and Four Pillars Capital Markets, Northmarq established itself as a provider of opportunities across all major asset classes. For more information, visit: www.northmarq.com.