January Economic Commentary: Fed accelerates policy shifts in response to inflationary pressures

Chief Economist

Pohlad Companies

While the acceleration of daily new cases of the Omicron variant was commanding most headlines in December, the Federal Reserve met to address the continuing surge in inflationary pressures. The minutes from that meeting indicate that the Fed is planning to remove the COVID-induced monetary accommodation from the economy at an even quicker pace than originally announced at their previous meeting in November. A less accommodative Fed, coupled with the expiration of most fiscal stimulus, will have a pronounced slowing impact on the economy in 2022.

Inflation The reading for November inflation was released in early December showing the Consumer Price Index (CPI) growing at 6.9% year over year – the highest reading in 40 years. Most concerning was the fact that there was mounting evidence of a strong pickup in cyclical pricing pressures that would support more persistent inflationary pressures. The upcoming reading on December inflation is expected to top 7%. The high inflation readings are dampening consumer sentiment and, consequently, consumer spending is expected to slow. Real (adjusted for inflation) personal disposable income has declined in seven out of the last eight months. Incomes are not keeping up with inflation. Not surprisingly, in each of those seven months, we’ve also seen the level of personal savings decline. The savings rate is now lower than where it was at the outset of the pandemic. The consumer is at the point where they’ve spent the excess savings they gained as a result of fiscal stimulus. With no additional upcoming fiscal stimulus and elevated inflation readings, there’s going to be a change in spending habits.

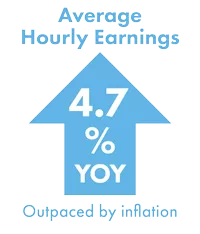

Employment The December employment report showed a disappointing gain of 199,000 in non-farm payrolls; expectations were for a 450,000 gain. Similar to November, the household survey reported a much stronger reading than the establishment survey with a 651,000 gain and, coupled with only a 168,000 increase in the labor force, the unemployment level fell to 3.9%. The number of unemployed fell by 483,000. Average hourly earnings are growing at 4.7% year over year, more than 2% lower than inflation. With a tight labor market and a labor force that is 2.3 million below the pre-pandemic level, upward wage pressures are expected to continue.

Fed Policy Changes As mentioned above, the Fed has announced intentions to move to a more hawkish stance in response to the elevated inflation readings. Chair Powell has made it clear that the Fed believes that price stability is necessary for maximum employment. In addition to accelerating the tapering of their bond purchase program to end in February, the median projection among Fed voting members is for three interest rate hikes in 2022. The first hike is likely to be in the spring. Finally, a majority of the members are in favor of reducing the size of the Fed’s balance sheet. This would start by allowing maturing bonds to run off but could evolve into selling some longer-dated bonds to push longer yields higher. So, you will have a cessation of bond buying, an increase in interest rates, and possible sales of bonds – that’s a complete reversal from where their policy was 18 months ago. The macro-economic backdrop is changing. The economic recovery has been fueled by an accommodative monetary policy and a super stimulative fiscal policy. While responsible for the quick economic recovery, these policies have also caused many of the imbalances in supply and demand we see today. With both of these drivers of recovery reversing, we should expect to see slower economic growth in 2022. It is the Fed’s desire to create a soft landing in the economy in which inflationary pressures abate and growth slows but does not contract. When you include the ongoing uncertainties associated with the Omicron variant and its impact on the economy, the Fed’s job has become most challenging and open to possible policy errors.

Insights

Research to help you make knowledgeable investment decisions