Economic Commentary on April 2019 Employment Report

Chief Economist

Pohlad Companies

A lot of important economic data has been reported during the past two weeks.

The U.S. Department of Commerce issued the initial reading of first-quarter GDP on April 26 that showed the economy accelerating to a 3.2% annualized growth rate from the 2.2% rate in 4Q-18. The year-over-year rate of growth also improved to 3.2% (the strongest year-over-year growth rate since 2Q-15), up from the 3.0% rate through 4Q-18.

Despite the strong headline number of 3.2%, the composition of the growth was troubling. Specifically, consumer spending was weak at 1.2%, down from the 2.5% rate in 4Q-18. Additionally, large contributions from inventory builds and net trade are not sustainable and will likely reverse in 2Q-19 and present a drag on that quarter’s results. Elevated policy uncertainty, decreased global trade, and the extended government shutdown contributed to this abnormal mix of economic growth.

Final sales to domestic purchasers, a better indicator of consumer demand, saw a significant slowdown to 1.4% in 1Q-19 from 2.1% in 4Q-18. This is the weakest reading of this metric since 4Q-15.

Inflation remains subdued as the impact of moderately higher wage growth has been offset by softness in many commodity and import prices due to the strong dollar. Unit labor costs remain muted at 0.1% year over year. Until labor costs firm more appreciably, the transmission mechanism into overall consumer prices will remain constrained.

As a result of the profit growth in 2018, we have seen strong growth in corporate investment in intellectual property the past several quarters. This reflects corporations spending to increase their productivity in the face of rising labor costs. Rising productivity growth (now at the highest level in eight years) is keeping unit labor costs contained and shielding corporate profitability.

Profit comparisons to the prior year will be challenging for all of 2019 as the impact of the Tax Cut and Jobs Act of 2017 subsides and global growth continues to slow.

On April 30, the Fed’s Open Market Committee (FOMC) met on schedule and held interest rates steady (Fed Funds at 2.50%) by unanimous vote while acknowledging the weakness of the first-quarter GDP report. In the press conference following the meeting, Chairman Powell suggested that low inflation, as well as soft consumer spending and business investment were “transitory.”

The Fed Funds futures market is now pricing in a 25% chance of a rate cut in September and a 55% chance of a cut by January of 2020.

The April employment report released May 3 showed an addition to nonfarm payrolls of 263,000 vs estimates of 190,000. Despite a very weak employment report in February, job creation has averaged 205,000 per month in 2019.

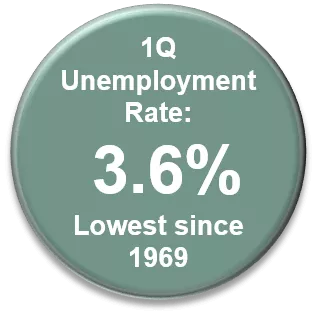

The unemployment rate dropped to 3.6%, the lowest reading since 1969. The drop was due to a large reduction (490,000) in the size of the labor force—not the reason we like to see improvement in the unemployment rate. Wage gains remain muted, coming in at 3.2% year over year, below estimates. The market is viewing this as another report that is strong enough to allay concerns that the employment picture is weakening but not too strong to push the Fed to take their finger off the pause button.

All of this suggests that the Fed is likely to remain on hold until they see deterioration in the labor market (justifying a cut in interest rates), or a more persistent acceleration in inflationary pressures (justifying an increase in interest rates). The current accommodative monetary policy will be offset by the fading impact of the 2017 tax cuts, ongoing trade tensions, and cooling of global economic growth.

Insights

Research to help you make knowledgeable investment decisions