Economic Commentary for December: Strong employment numbers, but consumers becoming cautious

Chief Economist

Pohlad Companies

Economic data released during November continued to paint the picture of a slowing, but not contracting, economy. Consumer spending is moderating, and the personal savings rate is near the upper end of its range of the past five years—indications that consumers are becoming more cautious. With American business reluctant to ramp up capital investment due to trade policy uncertainty, weak global demand, and slowing profit growth, consumer spending in the U.S. (accounting for 70% of GDP) is the primary support for continued economic growth.

GDP

The second estimate of 3Q-19 Real GDP indicated that the economy increased at an annual rate of 2.1%, up from the initial reading of 1.9%. The primary driver of the revised increase was inventory building—not viewed as a sustainable way to increase GDP.

Corporate Profits

More importantly, this report included initial information on corporate profitability in 3Q-19. Corporate profits were up 0.2% from 2Q-19 when profits grew 3.8% from the prior quarter. On a year-over-year basis, corporate profits declined 0.8%. The weakness in corporate profit growth is a result of tightening profit margins in a tight labor environment. Slower corporate profit growth continues to constrict business investment and may ultimately impact hiring plans.

More companies are trying to pass through the impact of the tariff increases to the consumer, but a recent survey by the Fed indicates that less than 50% of companies are able to do so—thus the tightening of margins.

Employment & Earnings

The employment report for November, released on December 6, was much stronger than even the most bullish forecasts. Nonfarm payrolls rose 266,000 in November compared to a median estimate of 180,000. Coupled with 41,000 of upward revisions to the prior two reports, it suggests that retailers will enjoy a good holiday sales season.

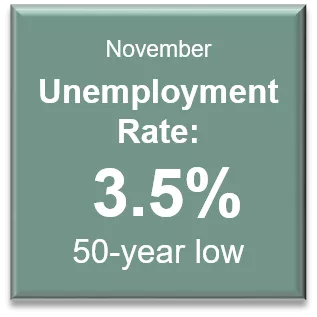

The unemployment rate moved back down to its 50-year low of 3.5%. The broadest measure of unemployment, the U6 rate that includes marginally attached workers plus part-time employed for economic reasons, is at 6.9%; the low of the past 25 years is 6.8%.

Average hourly earnings are growing 3.1% on a year-over-year basis but still do not reflect the overall tightness of the labor market. Although economic growth is slowing, average hourly earnings growth is holding relatively steady—another indication of tightness in the labor market.

Interest Rates

The Fed is likely to leave interest rates at current levels (Fed Funds 1.5% - 1.75%) at their December 11 meeting given recent data. The Fed remains concerned with the low level of inflation. Their preferred measure, the Core Personal Consumption Expenditure Index, was recently reported at 1.6% on a year-over-year basis, down from 1.7%. Chairman Powell has said that rates will not be increased again until inflation rises materially and surpasses 2%. Market expectations point to no moves in interest rate policy through the middle of 2020.

The biggest determinant of long-term interest rates is inflation and inflationary expectations. Until we can see the development of more persistent inflationary pressures, expect long-term interest rates to remain at or near historically low levels.

Consumers are the bellwether

Finally, the primary support of the U.S. economy continues to be the consumer. Any softening of the labor market will quickly reverberate through the economy via reduced consumer spending. Monitoring the ongoing health of the U.S. labor market, then, continues to be critical in assessing potential future economic activity.

Northmarq is a full-service capital markets resource for commercial real estate investors, offering seamless collaboration with top experts in debt, equity, investment sales, loan servicing, and fund management. The company combines industry-leading capabilities with a flexible structure, enabling its national team of experienced professionals to create innovative solutions for clients. Northmarq's solid foundation and entrepreneurial approach have built an annual transaction volume of more than $39 billion and a loan servicing portfolio of more than $76 billion. Through the 2022 acquisition of Stan Johnson Company and Four Pillars Capital Markets, Northmarq established itself as a provider of opportunities across all major asset classes. For more information, visit: www.northmarq.com.