Dallas-Fort Worth Q2 Multifamily Market Report: Vacancy Rates Fall as Absorption Accelerates

Highlights:

- The Dallas-Fort Worth multifamily market posted a very strong period of operating performance during the second quarter. Absorption reached a quarterly total not seen in years, driving vacancies lower and pushing rents higher. Investors responded to these trends by stepping up transaction activity and pushing prices higher.

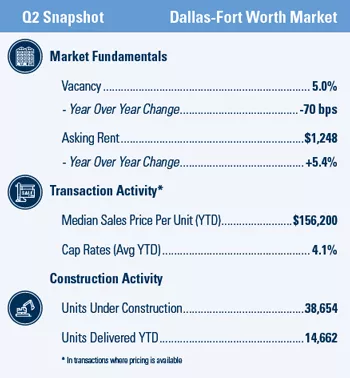

- Vacancy in Dallas-Fort Worth ended the second quarter at 5 percent, down 70 basis points from one year earlier, and 100 basis points lower than during the first quarter.

- The steep decline in the local vacancy rate was sparked by a spike in absorption levels. Net absorption topped 15,000 units during the second quarter; absorption year to date is up 30 percent when compared to the first halves of recent years.

- Rents gained momentum during the second quarter. Current rents are up 5.4 percent year over year at $1,248 per month.

- Investment activity accelerated during the second quarter, rising 30 percent from the first three months of the year. In transactions where pricing information was available, the median price in 2021 has reached $156,200 per unit, while cap rates have compressed to 4.1 percent.

Related Articles

Insights

Research to help you make knowledgeable investment decisions