Chicago Q1 Multifamily Market Report: Vacancy Tightens as the Economy Starts to Rebound

Highlights:

- The Chicago multifamily market recorded mixed performance during the first quarter, but there were more positive signs than negative ones. Absorption gained momentum, supporting a slight quarterly vacancy improvement. Rents ticked lower but are expected to begin to trend higher in the coming quarters.

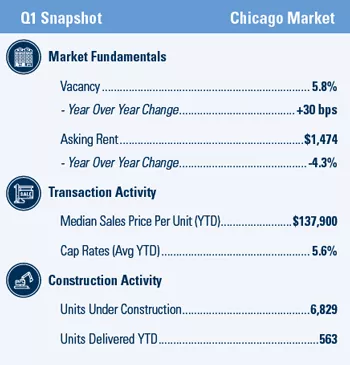

- Vacancy fell 10 basis points during the first quarter, reaching 5.8 percent. This was the first quarterly vacancy decline since 2019. Year over year, the vacancy rate has risen 30 basis points.

- Rents contracted to start the year, but the decline was less severe than dips recorded at the end of 2020. Asking rents ended the first quarter $1,474 per month, 4.3 percent lower than one year ago.

- Apartment developers delivered fewer than 600 units in the first quarter, the fewest units to come online in a single quarter in nearly five years. Projects totaling approximately 6,800 units are currently under construction.

- A broad mix of properties changed hands at the start of the year. The median price rose to $137,900 per unit, while cap rates compressed to 5.6 percent.

Related Articles

Insights

Research to help you make knowledgeable investment decisions