April Economic Commentary: Persistent Inflation Drives Tightening Monetary Policy as Labor Market Recovery Continues

Chief Economist

Pohlad Companies

The Fed’s much anticipated first monetary policy tightening cycle since 2016 was officially initiated on March 16 with the announcement to increase the Fed Fund’s rate by 0.25%. While recognizing ongoing uncertainties in the world such as Ukraine and COVID, the Fed made it clear that they are intent on bringing inflation down in the U.S. and are prepared to make additional hikes at each of their scheduled meetings this year. Incoming data fully support the need for the Fed’s action as shown in the following comments.

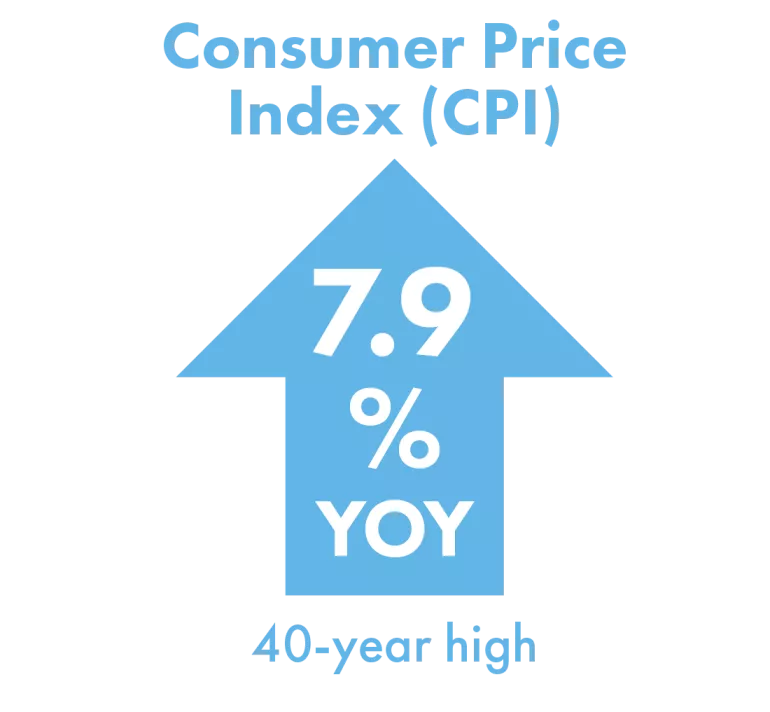

Inflation up 7.9% year-over-year

The week before the Fed meeting, the Consumer Price Index (CPI) for February was reported as advancing 7.9% year-over-year. That was up from a 7.5% advance in January and represented another 40-year high in inflation pressures. Stripping out food and energy prices, the core rate was up 6.4% from 6.0% in January. The persistence of the high inflation readings is now seen to be impacting wages, which raises the risk of increasing embedded inflationary pressures. Inflation is expected to ease as we move through the year, but the Ukrainian situation will keep inflation from falling as much as previously forecast.

Real disposable personal income (the money left over after paying taxes and adjusted for inflation) has been negative for 10 out of the last 11 months. Incomes are not keeping up with inflation and consequently consumers have had to tap into savings. Those savings levels are now below where they were pre-pandemic, and consequently consumer spending has started to slow. Rising gasoline prices are an everyday reminder of the price increases consumers are facing and are contributing to overall weak consumer sentiment and confidence.

Labor market continues recovery

One bright spot for the economy has been the continued strength of the labor market recovery. The employment report for March showed a rise of 431,000 in non-farm payrolls. Importantly, there was a 418,000 gain in the labor force with many younger workers re-entering the labor market. The rise in the household survey of 736,000 resulted in the unemployment rate dropping to 3.6% from 3.8% and is now just above the pre-pandemic reading of 3.5%. The number of unemployed fell by 318,000.

Annual wage growth rose to 5.6% year-over-year from 5.2%. Although difficulty in hiring continues to pressure wages, wage growth may be in the process of peaking with the large, reported gain in the labor force and a stabilization in job postings indicating easing in labor demand. The share of companies reporting that they are planning on raising wages has dropped, as well.

The strength of the labor market is the primary reason that the Fed’s Chair Powell believes that the Fed can hike rates aggressively to combat inflation without raising unemployment and risking a recession, at least in the near-term. Subsequent to the March 16 announcement, Powell stated that the Fed is prepared to raise interest rates by 0.50% at its next meeting in May, and at subsequent meetings, if needed. The Fed could also finalize plans to reduce the size of their balance sheet at the May meeting. Both actions – raising rates and reducing the balance sheet – will reduce market liquidity, slow economic activity, and eventually reduce inflationary pressures. The biggest unknown is how fast the Fed will need to move in order to slow the economy enough to dampen inflationary pressures.

Q1 GDP estimates between 1-2%

The initial reading for first quarter real GDP for 2022 won’t be reported until the end of April, but initial estimates are for a reading between a 1.0% and 2.0% annualized growth rate. The fourth quarter 2021 real GDP was 6.9% annualized. The weakness in the first quarter number is due to the impact of Omicron in the early part of the quarter and the elevated inflation pressures, which are slowing consumer’s ability and willingness to spend.

With no fiscal relief in sight, tightening monetary policy, and slowing growth, the Fed’s challenge to engineer a soft landing for the economy is fraught with execution risk.

Insights

Research to help you make knowledgeable investment decisions